Jeffrey Epstein, a financier whose criminal activities and connections to powerful figures became a global scandal, left behind extensive correspondence and records that shed light on his dealings and observations on finance and international affairs. Beyond the personal and criminal aspects of his life, some of these documents reveal insights into global financial mechanisms, including the European bailout programs.

One recurring topic in Epstein’s communications involves Greece and the European Financial Stability Facility (EFSF). During the 2010s, Greece faced a severe debt crisis, prompting bailouts orchestrated by the EU, the European Central Bank, and the International Monetary Fund.

On the official U.S. Department of Justice website, under the Epstein library section, Greece is mentioned over 1,500 times, including in email correspondence, research papers, travel records, and market reports. While some documents focus on general market analysis, most, if not all, reference Greece’s banks, bailout program, and financial markets.

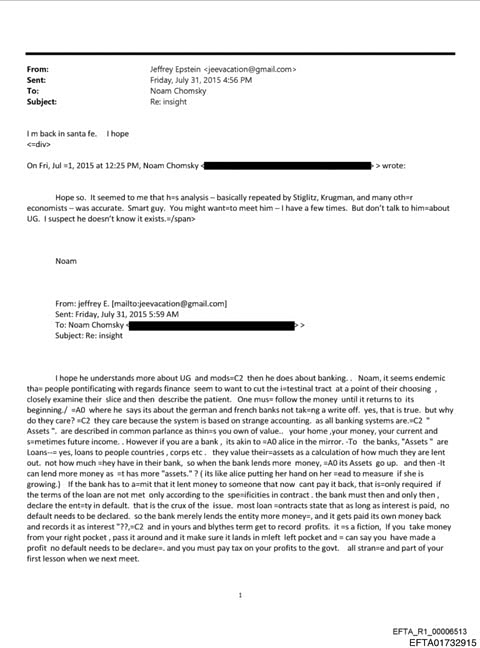

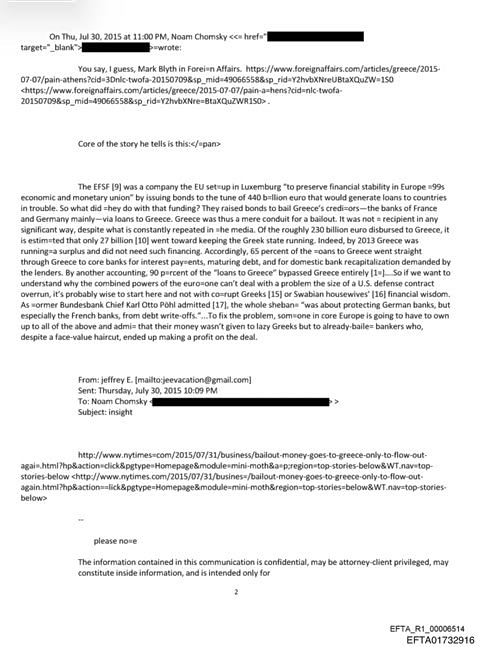

Document 1: July 31, 2015 – Correspondence with Noam Chomsky on Greek Bailout

In a detailed email to Noam Chomsky, Epstein discusses the mechanics of banking and the Greek bailout.

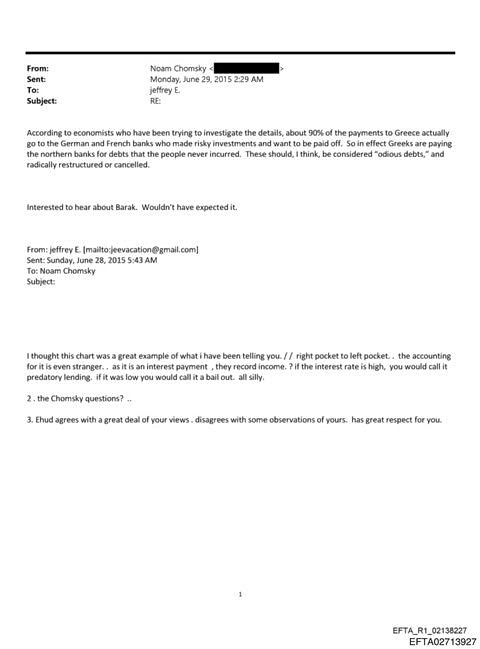

Document 2: June 29 2015 – Interest Payments and “Odious Debts”

In another email to Chomsky, Epstein emphasizes the disproportionate flow of bailout funds:

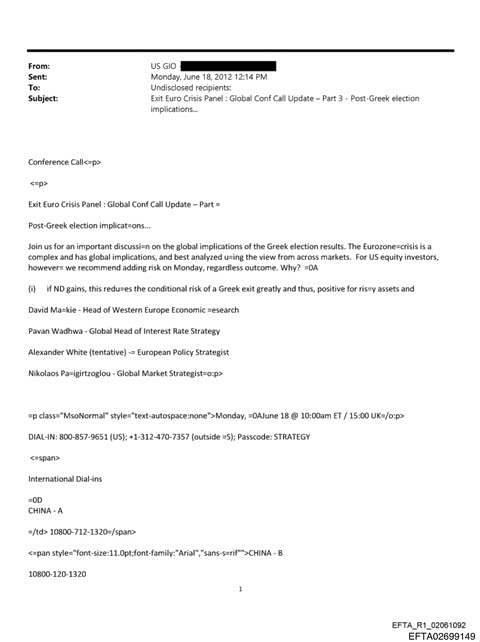

Document 3: June 18, 2012 – US GIO Conference Call on Greek Election Implications

A June 2012 internal communication from the US Global Investment Office outlines the implications of Greek elections on global markets. The document refers to a conference call, that analyzed the potential impact of election outcomes on Greece’s position in the Eurozone.

Document 4: March 2012 – Learning About Greek Debt Swaps

In correspondence from March 2012, Epstein references learning about Greek debt swaps.

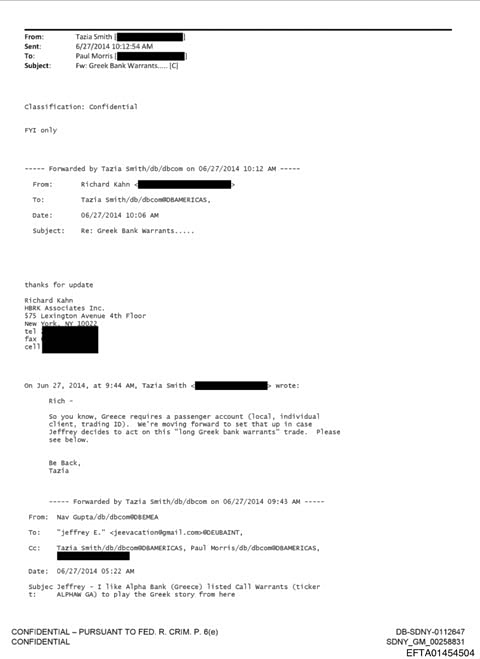

Document 5: June 2014 – Greek Bank Warrants

Epstein was informed about potential investments in Greek bank warrants. Tazia Smith noted the setup of local accounts to prepare for trades in “long Greek bank warrants,”. The emails included background on Greek banks’ recapitalization following the Private Sector Involvement (PSI) in government bonds, noting that banks had high state ownership (35–70%) but were expected to return to profitability.

Pages 1, 3, and 4 are included from the document.

Document 6: December 2013 – Short-Term Greek Sovereign Paper

Nav Gupta described an opportunity for investing in illiquid five-month Greek government bonds. Pages 7, and 9 are included from the document.

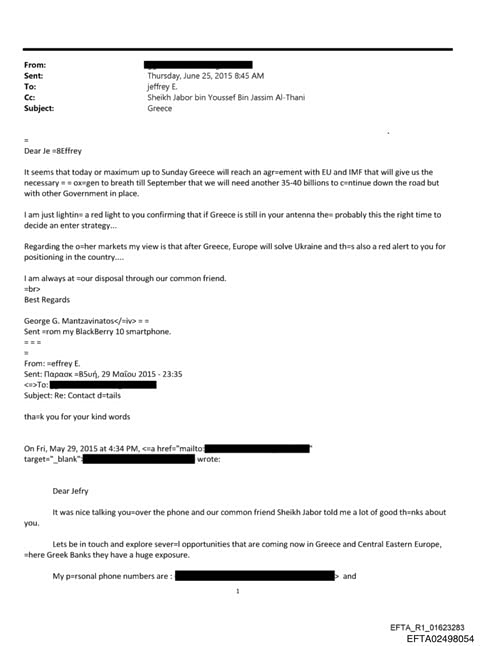

Document 7: June 25 and May 29, 2015 – Strategic Investment Discussions

Epstein corresponded with the late George G. Mantzavinatos regarding investment timing and opportunities in Greece and Central Eastern Europe. Mantzavinatos advised that Greece would likely reach an agreement with the EU and IMF by the end of June 2015, providing temporary financial stability until September, when another €35–40 billion would be needed. He suggested this was an opportune moment for Epstein to consider entering the Greek market, particularly in banks with large exposures. Mantzavinatos also highlighted other geopolitical risks, such as Ukraine, signaling potential investment considerations in Europe.