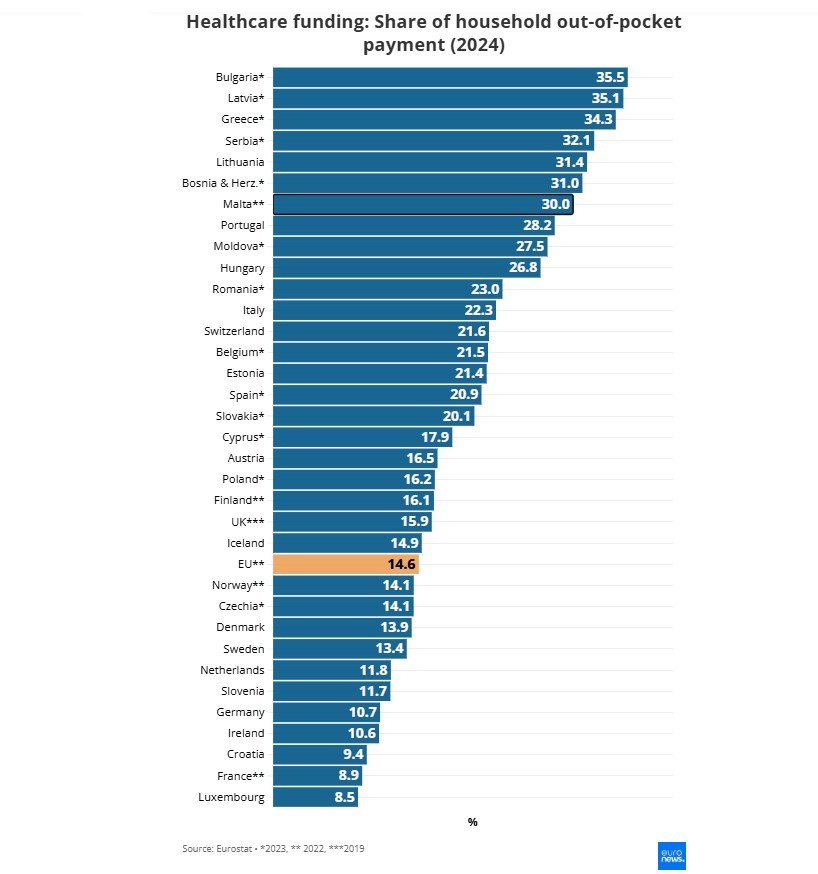

Recent data from Eurostat reveal significant disparities across European Union countries in household spending on healthcare. Greece stands out, with more than one in three citizens (34.3%) paying out of pocket for medical services, compared with the EU average of 14.6%.

These private expenses often include medications, medical tests, and hospital care that are not reimbursed by public health services. In countries like Greece and Bulgaria, households have limited protection against “catastrophic” health costs, leaving many vulnerable to financial strain.

Impact on Households

Across the EU, mandatory health insurance contributions cover 51% of healthcare costs on average, while governments cover another 30%. The remainder must be paid directly by households. This system exposes low-income families to difficult choices, often leading them to postpone or skip medical examinations and necessary treatments due to cost, long wait times, or distance from healthcare providers.

In 2024, over 21% of adults in Greece reported that they did not undergo necessary medical tests or treatments because of financial constraints or other barriers. Studies by professors Michael Chletsos and Charalambos Oikonomou for the World Health Organization describe this as “health impoverishment,” noting that 3% of Greek households in 2023 were pushed into extreme poverty due to out-of-pocket health spending. Another 10% faced “catastrophic” costs, defined as 40% of disposable income spent on healthcare.

European Comparison

The Eurostat survey, covering 34 EU countries, highlights a stark East-West divide. Bulgaria leads with 35.5%, followed by Latvia at 35.1%, and Greece at 34.3%. Other countries with high household burdens include Serbia (32.1%), Lithuania (31.4%), and Bosnia-Herzegovina (31%).

In contrast, Luxembourg (8.5%), France (8.9%), Croatia (9.4%), Ireland (10.6%), and Germany (10.7%) show the lowest out-of-pocket spending. Among the five largest European economies, Italy is highest at 22.3%, followed by Spain (20.9%), while France and Germany remain lower, with the UK slightly above the EU average at 15.9% (2019 data). Scandinavian countries also maintain low levels, with Sweden at 13.4%, Denmark 13.9%, Norway 14.1%, and Finland 16.1%.

Causes of Disparities

National health insurance policies largely explain these differences. According to Professor Jonathan Cylus of the London School of Economics, such policies determine who is covered, which services are included, and the level of financial protection. In countries like Bulgaria and Greece, limited coverage means that households must pay for many services themselves, particularly medications outside hospitals, dental care, and diagnostic tests.

Conversely, countries with comprehensive public or social insurance systems—like France, Germany, and Sweden—offer extensive coverage, low or zero co-payments for essential services, and strong protections for vulnerable groups.

Annual Out-of-Pocket Costs

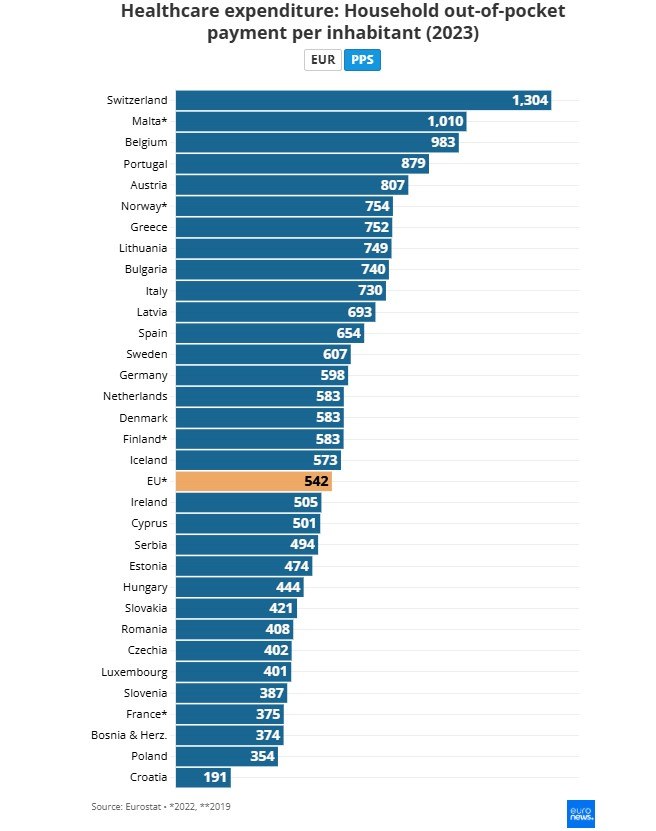

In 2023, the average EU citizen spent €542 per year out of pocket on healthcare, with a range from €116 in Moldova to €2,396 in Switzerland. Within the EU, costs varied from €136 in Croatia to €1,176 in Belgium, while Norway exceeded €1,000 annually.

Among major EU economies, French citizens paid the least (€410 per year), whereas Italians faced €718, Germans €652, Britons €609, and Spaniards €596. Differences are influenced by demographic and epidemiological factors, including aging populations and prevalence of chronic conditions, which increase demand for medical and long-term care.

Recommendations for Greece

Experts suggest that Greece could improve financial protection by expanding the national health insurance program (EOPYY) to cover all residents, including those reliant on public facilities, and by carefully allocating the national budget to reduce unmet healthcare needs among low-income households.

These findings underscore persistent inequalities in Europe, showing that while wealthier countries shield citizens from excessive healthcare costs, households in Southern and Eastern Europe continue to face disproportionate financial burdens.