When the U.S. and Europe tried to sever Russia from the Western financial system, Moscow found workarounds. Key among them: banks in the Gulf and Europe that maintained ties with Russia.

Now, Washington’s efforts to close these loopholes appear to be paying off. Dubai’s main state-owned bank has shut some accounts held by Russian oligarchs and traders of Russian oil. Turkish lenders are growing wary of handling Russia-related business. The U.S. has also put bankers in Vienna, another important financial hub, on notice.

The moves follow visits by U.S. officials, and recent rounds of sanctions against trading firms and others. In late December, the White House gave the Treasury Department greater sanctions power , enabling it to penalize foreign banks for dealings involving Russia’s military-industrial base.

Emirates NBD , the Dubai-based banking giant, is central to the shift.

Russian businesses and oligarchs flocked to the United Arab Emirates , including the commercial hub of Dubai, after Moscow invaded Ukraine in 2022. Emirates NBD was one of the biggest beneficiaries, according to people familiar with the matter, including financial professionals in the Persian Gulf country, U.S. officials and an energy executive.

The bank handled sizable Russia oil trades and set up a department catering to Russians seeking a safe haven for their wealth, for which it poached bankers from the former Soviet Union, said one of the U.S. officials and some of the other people familiar with the matter.

In recent months, however, the U.S. has applied heavy pressure on the U.A.E. Washington has sent Treasury and State Department officials to the nation, and imposed new sanctions on U.A.E.-based entities such as the Russia-focused oil trader Voliton.

Emirates NBD has reversed course. It has shut its Russia-focused department, stopped accepting transfers in rubles from Russia and closed a large number of Russian-held accounts, typically either containing more than $5 million or held by sanction-connected entities, the financial professionals in the Emirates and another of the people familiar with the matter said.

Some of the closures affect companies in a network of trading and shipping companies operated by Etibar Eyyub, a former executive at the U.A.E.’s Coral Energy.

This network, which includes Voliton and another recently sanctioned firm, Bellatrix Energy, has become the key route through which the Russian state exports oil to global markets, The Wall Street Journal has previously reported.

Emirates NBD has ordered the closure of accounts held by Coral, Voliton, Bellatrix and another Eyyub-linked firm, Pontus Trading, one of the U.S. officials and other people familiar with the matter said.

A spokesman for Emirates NBD said it couldn’t comment on specific clients, but was committed to fighting financial crime and money laundering, and to complying with applicable international sanctions.

“The bank works closely on these priorities with its regulators and law enforcement agencies in the U.A.E. and other relevant jurisdictions,” the spokesman said.

A spokesperson for Coral said it maintains strong working relationships with all banking partners, and that the Journal’s questions were based on “an inaccurate or misleading premise.” The spokesperson has previously said Coral has nothing to do with the firms operated by Eyyub.

Spokespeople for Pontus, Bellatrix and Voliton didn’t respond to requests for comment.

Emirates NBD has also shut accounts held by Russian fertilizer giant Uralkali, and by Russian businessman Ivan Tavrin , according to the financial professionals in the Emirates. In December, the U.S. sanctioned Tavrin, who has spent billions of dollars buying up technology companies, as “one of Russia’s biggest wartime dealmakers.”

Representatives for Tavrin, and Tavrin’s Kismet Capital didn’t respond to requests for comment.

After the publication of this article, a spokesman for Urakali said in an email the information regarding the closure of Uralkali’s Emirates NBD accounts “is not accurate, as the company does not have any accounts in this financial organization.” He didn’t respond to requests for further comment.

In addition to Emirates NBD, the Dubai branch of Banque Misr has shut down accounts for Coral and some other companies, according to some of the people familiar with the matter. The small, state-owned Egyptian lender was one of a clutch of banks processing payments for the trading network, those people said. Banque Misr didn’t respond to a request for comment.

In Turkey, the climate has also changed, as the U.S. government has pushed Ankara to adjust its growing economic relations with Russia.

The U.S. has penalized Turkish companies for aiding Russian violations and urged the government to foster sanctions compliance. Turkish exporters have complained of trouble getting paid.

“We are having difficulties receiving our funds,” said Omer Gencal, a financial adviser for Turkish companies doing business with Russia.

“Recently some banks said they are stopping their operations from transferring their funds from Russia to Turkey,” said Gencal, a former investment chief for HSBC ’s local asset-management arm.

Turkish exports to Russia in February fell 33% from a year earlier to $670 million, trade-ministry data show.

Alexei Yerkhov, Russia’s ambassador to Turkey, said Russia was “in intense talks with Turkish officials regarding the refusal of some Turkish banks making payments in the name of the Russian companies,” according to Russian state media.

The U.S. has also targeted Austria, a banking hub for Central and Eastern Europe, recently sending Treasury official Anna Morris to meet with the government and banks including Raiffeisen Bank International , which retains a unit in Russia.

Treasury said the visit was part of a broader international outreach to ensure financial firms understood its new sanction powers, which were meant partly “to create heightened risks for banks.”

Raiffeisen is trying to sell or spin off its Russian unit, though Moscow has made business exits difficult.

The bank said it has guidelines and procedures to ensure sanctions compliance. “Since the beginning of the war, RBI has been steadily scaling back its Russian business,” it said.

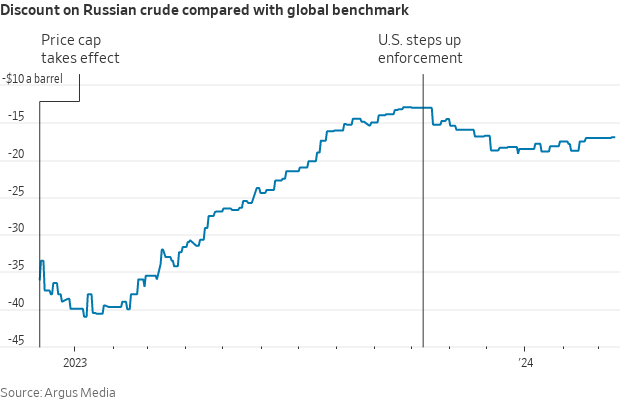

The redoubled U.S. effort has led to some disruption of Russia’s energy exports, a financial pillar for the war in Ukraine.

Voliton and Bellatrix were among the biggest resellers of oil pumped by Russia’s Rosneft Oil , shipping and customs data show. But neither Voliton nor Bellatrix has handled any Russian oil trades since being sanctioned, according to commodity-data provider Kpler.

The U.S. pressure on banks to clamp down on energy payments has caused complications in recent weeks, said the U.S. officials, the financial professionals in the Emirates and others. Nonetheless, Russian oil is still flowing freely.

Last month, the Financial Action Task Force, an international anti-money-laundering body, took the U.A.E. off its gray list of noncompliant countries, citing significant progress in addressing deficiencies.

Write to Benoit Faucon at benoit.faucon@wsj.com , Costas Paris at costas.paris@wsj.com and Joe Wallace at joe.wallace@wsj.com