It began with a notification: A user wanted to connect on LinkedIn, and sent a note saying she thought the man’s profile was impressive.

She seemed polite and attractive. The man, a 75-year-old professional who lives in the American Midwest, replied.

That was the start of a monthslong nightmare that emptied his retirement fund and drove him to the brink of suicide. He is one of millions of people globally to fall victim to “pig butchering,” a form of fraud in which scammers seduce strangers online, build their trust and convince them to put money into bogus investments.

They take the money and ghost their victims.

The Wall Street Journal reviewed thousands of messages between the man and the scammer, financial records, photographs and other documents that show how the fraud unfolded. It’s a disturbing glimpse inside the sophisticated psychological manipulation scammers use to prey on vulnerable people, especially those who are elderly and not technologically savvy.

The man, referred to in the story as the victim, lost more than $715,000—virtually everything he had. He declined to be named, but shared with the Journal months of WhatsApp conversations with the scammer, documentation of money transfers and screen grabs of the sham trading platform where he was swindled. He said he hoped the details would save others from his fate by exposing how scammers exploit average people and ruin lives.

The Bait

The scammers often pose as beautiful young women with lots of money and few cares, and convince their victims that they share a special, secret bond. In fact, they are often men contacting their targets from dystopian compounds run by Chinese criminal syndicates in parts of Southeast Asia and West Africa.

These “scam dens” are infamous for abuse. Many scammers are trafficked in, given scripts and smartphones preloaded with fake profiles, and forced to commit fraud under threat of violence.

The victim didn’t know any of that when he first got a LinkedIn message on May 31 of last year. The profile picture showed a young woman dressed in a blue T-shirt and red skirt, striking a demure pose next to a bouquet of flowers. After a few pleasantries, she suggested they migrate to WhatsApp to have a more private conversation and guided the victim through the steps of downloading and installing the app.

She drew him in by portraying a life the man dreamed of but never believed he could have. She said she lived in San Francisco where she worked for her wealthy and well-connected uncle. She sent him pictures of herself trying on designer clothes, dining in fine restaurants and posing next to her luxury car.

He told her his age, that he had a modest retirement fund and still worked full time. He also told her he lived with his partner of 40 years, but said they’d drifted apart.

Scammers specifically seek out the lonely—people living regular lives consisting of doctor’s visits, frozen food and errands. They lure them with the prospect of an exciting life that would otherwise seem out of reach.

His Ideal Woman

Her character was just believable enough.

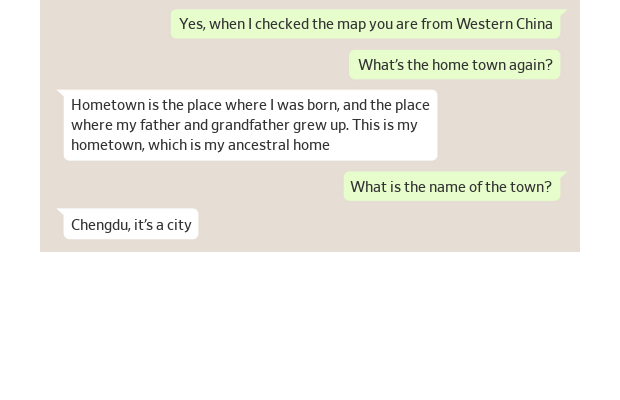

She said she had moved to the U.S. from China eight years earlier after her divorce. She had difficulty trusting men, she said, but at 37, she was lonely and longed for a companion. She said she didn’t care about age, appearance, money—she had plenty of her own. All she wanted was true love, she said.

She began revealing more about herself through their constant WhatsApp chats. She told him her American friends called her Violaine Chen, but that her real Chinese name was Deng Xinyi.

Violaine’s Chinese persona was intriguing to the victim. It also helped to smooth over inconsistencies in her story. She blamed errors on her imperfect English. Typos were excusable, as were messages that made little sense.

They bonded over their shared interest in things that were more or less universally liked: food, travel, fitness, pets.

Violaine sent him daily descriptions of her meals and workouts. She showed him pictures of Chinese dishes and explained their benefits. She said she never wasted food because she felt guilty about world hunger, and that she gave to charities that feed poor children in rural China.

Early on, they had a few brief voice calls and one video call, just a few seconds each. She was in a nondescript room and told him she was in a hurry, he said in interviews with the Journal.

It was enough to convince him she was real. He also didn’t want to spend much time on the phone because he worried his partner would catch him. And he didn’t like video calls because he was self-conscious about his looks and his messy house.

Nonprofits that rescue scammers who are forced to work in fraud dens say it’s common for the compounds to have models nearby for brief cameos. Sometimes these are the same models who pose for photographs used in fake profiles. Sometimes they just look similar.

To the victim, Violaine was his ideal woman: wealthy but also down-to-earth, virtuous yet sexy.

“She hooked me,” he said.

The Romantic Plan

Within two days, Violaine began implementing the next phase of the scam: getting him to put money on the table.

She started by explaining how she’d become so rich. She said she’d made a fortune trading gold futures—contracts that lock in commodities at a predetermined price. Her uncle, she said, owned a stake in a trading platform called FX6, and had a team of expert analysts who could predict when values were about to jump.

She said they watched for “nodes,” which the victim understood to be price fluctuations signaling an imminent move, and gave her uncle inside tips on when to buy and sell.

Using her uncle’s intel, she would buy the dip just before the break and sell a few minutes later. Her explanation didn’t fully make sense to the victim, but he trusted her and followed her lead.

She said she used an app called Fuex to trade on the FX6 market. Fuex was a registered company in the U.K. at the time, but has since been delisted. Fuex didn’t respond to an email, and the website the victim used to download the app no longer exists. Attempts by the Journal to contact “Violaine” went unanswered.

Erin West, a California prosecutor who specializes in cyber fraud, said there are so many websites like this one that regulators can’t keep up. These fraudulent online trading sites are modeled after real ones, but are developed by and controlled by the scammers.

They funnel money into a sprawling global network of shell corporations, West said, adding: “We’re talking about billions and billions and billions of dollars being expertly moved in a manner that we can’t catch it.”

The victim wasn’t tech savvy, which worked in Violaine’s favor. She walked him through the steps of setting up an account on Fuex and explained the unusual process of adding funds to his digital wallet.

First, she said, he’d have to initiate a chat with a Fuex customer-service agent and tell them he wanted to top up his balance. The agent would then send him a bank account number in which to deposit funds. Violaine advised the victim to tell his bank he was sending the money to a friend.

He struggled at every step. Violaine sent him screen grabs of the Fuex interface with circles and arrows scribbled on it to show him what to do and where to click. She was at times controlling, at times condescending. He tried to please her and apologized when he felt like he failed.

With Violaine’s persistent hand holding, he made his first deposit of $1,500 on June 2 to a stranger’s bank account in Hong Kong.

A Shared Future

At this point, romance and finance became inextricably linked. Violaine proposed what she called the “romantic plan”: She and the victim would invest equally in a shared fund on the platform that would earn enough for him to leave his partner. They’d buy a recreational vehicle, or RV, and take a road trip together to California.

The Pushback

Former scammers interviewed by the Journal said they’re trained for weeks and armed with scripts that help them respond to pushback. Violaine used several tactics they described when the victim showed unease.

The Fattening

It was time to show the victim how much money he could make.

In early June, Violaine guided him through the process of using the $1,500 in his Fuex account to buy and sell on FX6. She made it seem exciting, like watching a horse race. She told him to open the app at a certain time and wait for her instructions.

He ended up investing another $15,000.

She pressured him to call his bank and increase his transfer limit, which was set at $25,000.

They went back and forth on this issue, then she sent him a photo of herself saying she’d finished putting on her makeup. Sometimes when they argued or if he seemed suspicious, she would distract him with flirtatious chatter.

The victim tried to make a small withdrawal, $100, to test the platform. He was told the request would take a few days to process. It did and he received the money.

Red Flags

There were warning signs along the way.

The victim’s bank advised him against making the transfers, and bank staff warned him that they saw the hallmarks of a scam. But he trusted Violaine, who told him exactly what to tell the bank to get them to carry out his requests.

There was also reason to doubt that Violaine was real. At times her messages resembled content that had been lifted off the internet or generative-AI platforms. Some contained pieces of code, such as “ ,” suggesting text had been carelessly copied and pasted. Some just seemed like they weren’t written by an actual person, reading like detailed lists of obscure facts.

He brushed off the strangeness of her texts because English was her second language.

But the victim was immersed in what seemed to him like a strange and beautiful turn in his life.

Sizing Up the Spoils

The scammers try to figure out exactly how much their victim is worth—liquidity, investments, even how much they might be able to borrow from friends and family.

A week after they’d begun talking, Violaine asked how much cash he had on hand.

Violaine tested the limits to see how much he would invest, telling him they’d maximize profits if he had $200,000 to trade with.

Two days later, she asked him how much he had in stocks and bonds. He said it was about $460,000. On June 10, he sold $130,000 in stocks.

No sooner had he done that than she urged him to sell his mutual funds, but warned that his portfolio manager might try to stop him. She told him to be firm and act fast.

Every Last Penny

“One of the key elements is they will take every penny you have,” said West, the prosecutor. “That’s part of the con is to find out how much you have and take everything, it can be equally devastating to the man who loses $5 million as it is to the 22-year-old who loses $50,000—it’s everything they have.”

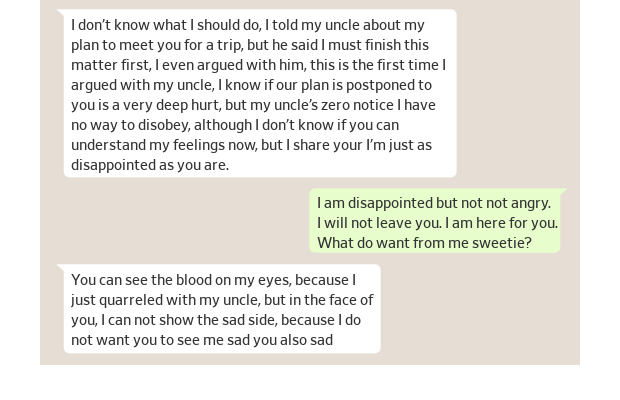

Toward the end of June, Violaine told the victim her assistant booked her on a United Airlines flight from San Francisco and she was finally going to come meet him in late June. But at the last minute, she said she was urgently needed in Argentina to complete a job for her uncle.

Violaine told him that she longed to be with him. She sent him pictures from Argentina, eating steak at a fine restaurant, lounging in her hotel room, and visiting the famous salt flats of Jujuy in the country’s north. The more they talked about their life together, the more he was willing to spend.

Through June and mid-July, he made three large deposits amounting to a total of more than $300,000 to an account in Hanoi.

Each time he put money in, the app appeared to show another equal or similar deposit that he believed was made by Violaine. By mid-July, their combined investments had grown to almost $1.5 million.

The Butchering

Violaine was ready to go in for the kill.

On July 13, she told him her uncle wanted them to buy a house in his Los Angeles neighborhood, so the family would be close together once they married.

She asked the victim to withdraw about half the funds from their trading account to use as a down payment, promising to pay it back once she returned to the U.S.

He tried to withdraw $700,000 from their Fuex account.

This final, savage stage occurs once the scammer thinks they have taken all the victim’s money. They’ll ask the victim to make a withdrawal, which will be blocked by the scammers, who control the back-end of the app. The scammers, acting as customer service agents for the app, then ask the victim to pay a fee to reinstate, or “unfreeze,” their account.

Because it was the scammer who told the victim to make the withdrawal, the victim is unlikely to suspect them. At this point, the victim either abandons their account and loses all their money, or scrounges up even more, sometimes by taking out loans.

The next day, the victim sent Violaine several screenshots of his chat with a Fuex support agent. It said the withdrawal request was rejected because his identity couldn’t be verified.

The agent told him to log in to FX6, fill out an authentication form and upload a photo ID. He was told his withdrawal request would be reviewed within 24 hours.

Frozen Out

He was beginning to panic. The 24 hours had passed, but instead of having his withdrawal request approved, he was notified that a freeze was put on his account for security reasons. He was asked to pay almost $640,000 to lift it.

Around July 22, Violaine told him she borrowed about $485,000 to help him pay the fee to unfreeze his account. He paid the rest: about $155,000 cobbled together by offloading his remaining investments and taking out a $45,000 bank loan.

He was told he’d made a clerical error that would cost another $212,000. He paid by dipping into a home-equity loan, which he shared with his unwitting partner, but it didn’t end there.

There were late fees, and something called a “risk fund amount.”

By this point, in less than two months, he’d sunk a total of $716,212 into the Fuex account.

‘Nothing To Live For’

Reality was sinking in. The victim had no more money to pay the fees that Fuex said would release his funds, and no longer believed Fuex would release the funds if he paid more fees.

He did report it, but nothing has come of his case. On Aug. 11, he submitted a detailed account to the Federal Bureau of Investigation’s Internet Crime Complaint Center, called IC3.

The FBI said such complaints are reviewed by trained analysts and forwarded to relevant law enforcement or regulatory agencies. The FBI doesn’t investigate these complaints and can’t provide status updates on them, as investigation and prosecution is at the discretion of the receiving agencies, the IC3 website says.

West, the prosecutor, described the IC3 as more of a “data collection point” than a justice mechanism.

Ghosted

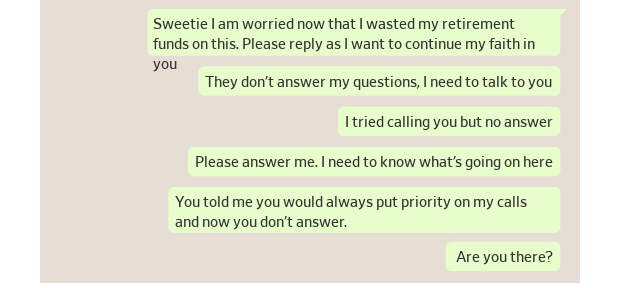

By mid-September, Violaine stopped responding to most of the victim’s messages.

By now, the victim had read reports about how pig butchering worked. He understood that the scammers are often themselves victims of human trafficking who are forced to commit fraud under threat of violence. But he still believed Violaine was real. He started to think she’d been trafficked and forced to deceive him.

He pleaded with her not to leave him. By now, the victim knew he’d been conned. But he still struggled to accept the possibility that his lover had a hand in the deception.

Every now and then, Violaine sends the victim another message asking for more money. He has stopped responding.

He’s had no luck tracing where his money has gone. He said that every day he tries again to access his Fuex account. It’s still locked.

Write to Feliz Solomon at feliz.solomon@wsj.com