The Greece–Egypt electrical interconnection “GREGY,” a project of strategic importance, is expected to serve as a lever for lowering energy costs for Greek households, fundamentally changing the landscape of the domestic electricity market.

At the same time, it will enable industries and electricity suppliers to sign long-term power purchase agreements (PPAs) at stable and competitive prices.

The wholesale price of electricity delivered to Greece through the cable is expected to be cheaper by €15–20 per megawatt-hour (MWh) than current levels by the end of the decade. This was stated by a senior executive of the Copelouzos Group — which is developing the project through its company Elica — speaking to journalists on the sidelines of the 6th Transatlantic Energy Cooperation Summit (P-TEC) held last week at the Zappeion.

“We estimate that by 2030–2031, when the project is completed, the average wholesale price of base load electricity — stable generation and supply across all hours of the day — will be around €70–75/MWh, and we believe we’ll be able to sell between €55 and €62/MWh,” the same source noted.

Secured Land for Renewable Energy

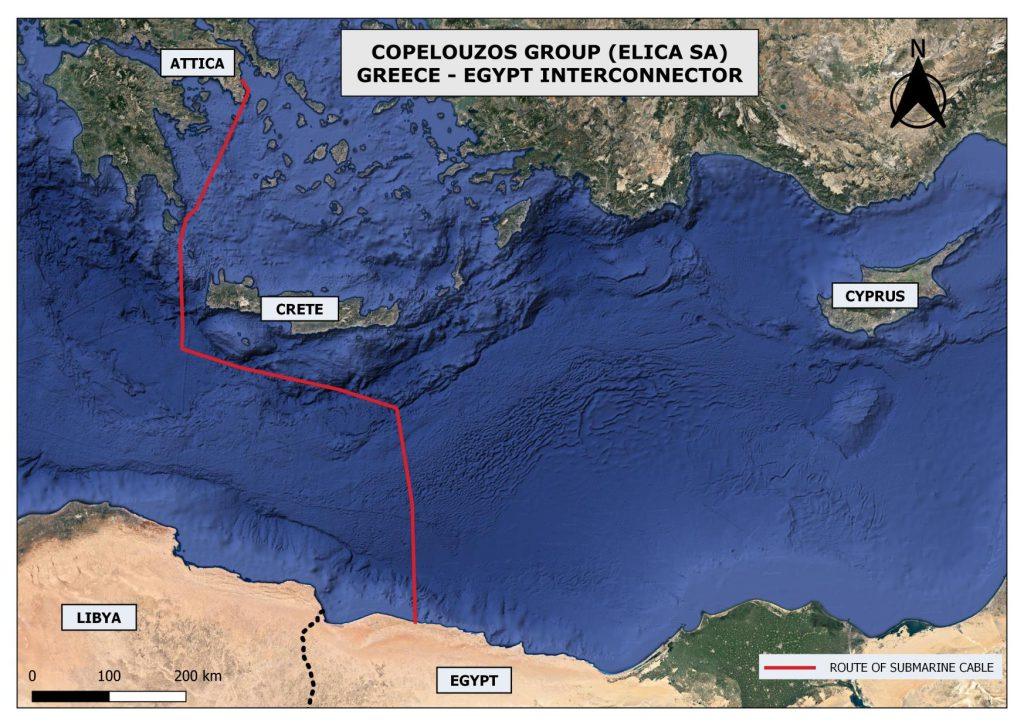

The subsea cable, with a total length of 954 kilometers and a budget of about €4 billion, will transmit 3 GW of “green” energy from renewable sources totaling approximately 9 GW, to be installed on Egyptian soil. About 75% of this energy will come from wind farms and the remaining 25% from solar power.

As revealed last week by Mr. Ioannis Karydas, CEO of the Copelouzos Group’s Renewable Energy and Energy Storage division, speaking at the Green Deal Greece 2025 conference of the Technical Chamber of Greece (TEE), after months of technical meetings and intergovernmental talks, the Egyptian government has allocated about 2,500 square kilometers of land along the country’s northern coast, near the border with Libya, for the development of renewable energy projects.

The Location and Progress of Agreements

This area was chosen because it includes the marine landing point of the electrical interconnection that will link Greece and Egypt. According to Mr. Karydas, the official agreement procedures with the Egyptian state are in their final stages and expected to be concluded within the coming weeks.

The selected sites — approximately 150 kilometers from the Libyan border, near the Mediterranean coast — were chosen for their strong and steady wind potential as well as their proximity to the converter station site. “The areas are being granted by the Egyptian government, and we will construct the renewable facilities, with the majority being wind farms, since the region’s steady winds allow for continuous 24-hour production,” the Group’s executive emphasized on the sidelines of the P-TEC.

Benefits for Greece and Industry

The benefits for Greece are considered multiple. Beyond providing low-cost electricity to suppliers and, consequently, to households, the project will strengthen Greek industry — currently strained by high energy prices — and attract new investment in energy-intensive infrastructures such as data centers and artificial intelligence units. “Around 60 large industrial companies have already signed agreements with us, since the base load electricity price from the cable will be significantly lower. Priority for cheap energy will be given to domestic consumption in Greece, and any surplus will be exported,” the same source underlined.

The European Dimension of the Project

The benefits of the interconnection for Greece have already been highlighted in a study by AFRY (through its UK subsidiary). Meanwhile, according to the company executive, the equivalent analysis for Egypt will be ready within the month. “Projects that are economically viable also carry a geopolitical dimension. Today, the strongest link between Greece and Egypt is the cable,” the executive noted.

Moreover, the EU supports the GREGY electrical interconnection as one of the energy “bridges” between Greece and Africa, recognizing its strategic importance for supply security and decarbonization.

Timeline and Next Steps

The project’s completion is not expected before 2030–2031. “It doesn’t depend solely on us. At present, there is huge global demand for subsea cables. However, we may benefit from President Trump’s policy, as he has canceled or suspended funding for offshore wind-related infrastructure in the U.S. and is reviewing permits, transit rights, leases, etc. As a result, cable orders have decreased, which may work in our favor,” said a Group executive.

Meanwhile, discussions are underway with financial institutions for funding and with suppliers for converter stations and cables, as well as for the cost-benefit and technical analyses and the feasibility study.

By the end of the year, a tender is expected to be announced for seabed mapping to finalize the cable’s route and landing points. The start of subsea surveys is planned for the first quarter of 2026, with completion expected in spring 2027. Barring unforeseen circumstances, the final investment decision is projected for the end of that same year.