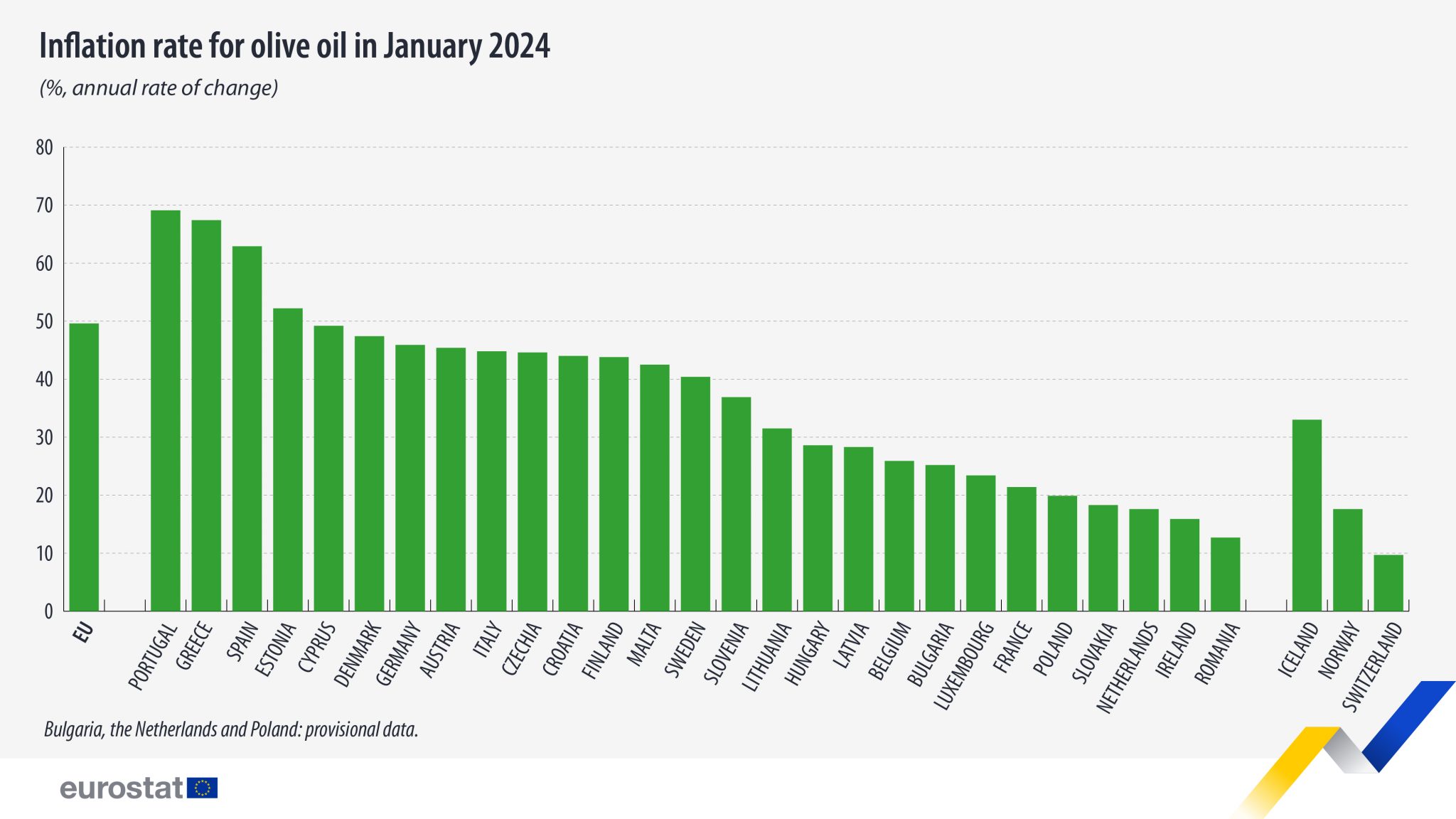

The cost of olive oil continued to skyrocket across the European Union, with Greece, Spain, and Portugal, the EU’s top oil-producing countries, remarkably recording the highest increases, according to a Eurostat survey.

Greece witnessed the second-highest price hike (+67%) compared to 2023, with Portugal taking the top spot (+69%) and Spain rounding off the top three most expensive countries in the EU.

“Olive oil inflation”, as the pundits have dubbed the exorbitant costs of the food staple, is running at double-digit rates in all the EU member-states, as according to Eurostat data for January 2024, the price of olive oil in the EU was 50% higher than in January 2023.

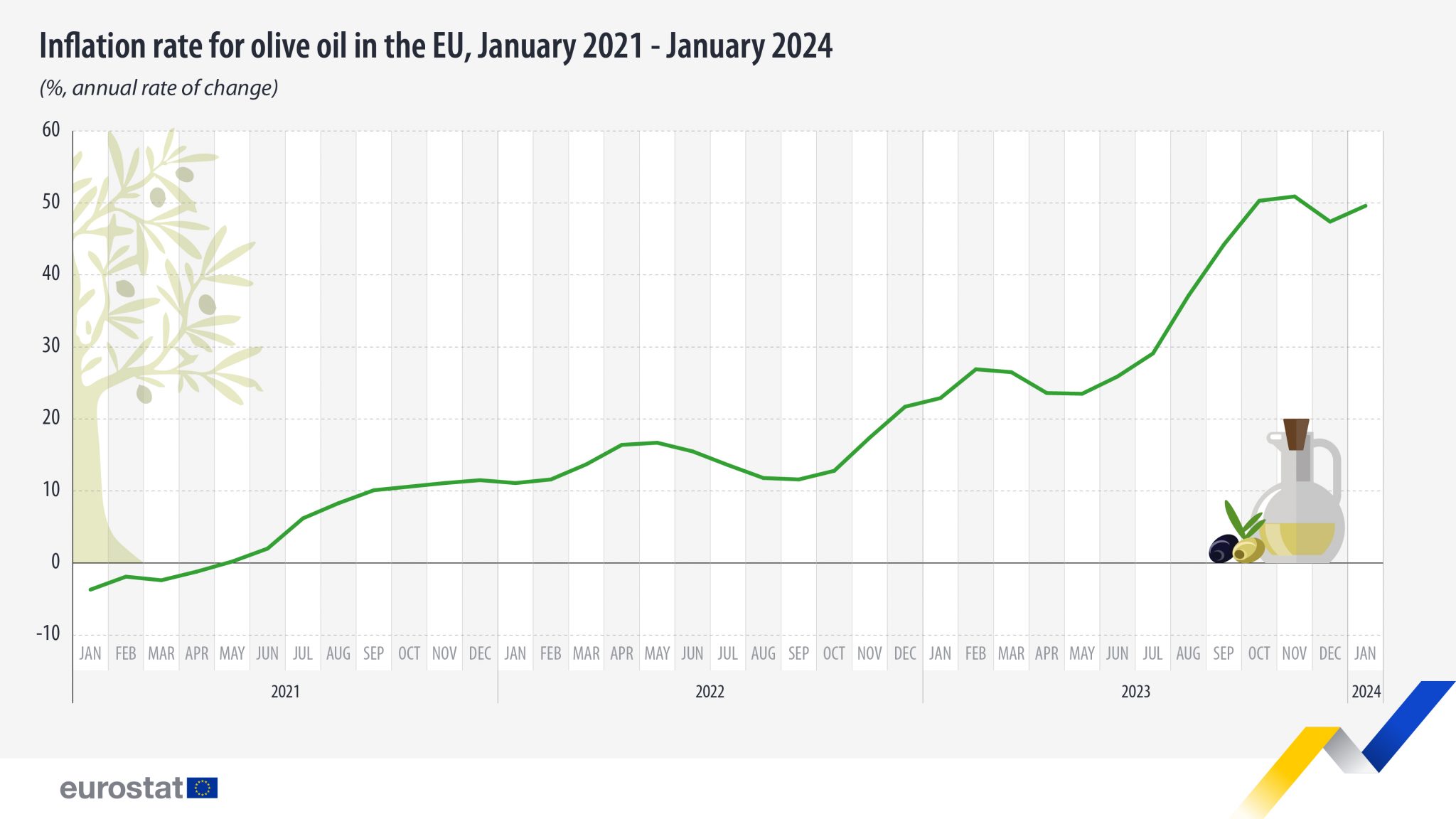

The stats revealed the price of olive oil soared in the second half of 2023 with an increase of 37% in August (compared to August 2022), a trend that accelerated in September (+44%) and October (+50%).

The annual peak of cost was recorded in November 2023 (+51% compared to November 2022). In December, there was a slight deceleration, as prices were 47% higher (compared to December 2022).

On the opposite spectrum of Portugal, Greece, and Spain (the most expensive), Romania (+13%), Ireland (+16%), and the Netherlands (+18%) are experiencing the smallest price increases, according to the individual data published by Eurostat, in January 2024.

The market

The olive oil sector is facing unprecedented challenges from the production stage with reduced harvests in the main producing countries (Greece, Spain, and Italy), soaring prices, bleak forecasts for shortages, and an estimated reduction in consumption.

According to analysts, high costs are persisting due to lasting demand from export markets, even in the face of a small reduction in local consumption.

Production problems

According to the most recent European Commission data (February 15, 2024), OT.gr analyzed, production in Greece from October 2023 to January 2024 amounted to 131,500 tons for the 2023/24 season, while it is estimated that the final quantities will amount to 155,000 tons.

Due to poor harvests in Spain and Greece, Italy is expected to produce one-third of Europe’s olive oil this year.

Challenges

Poor weather conditions and frosts in late March caused damage to olive flowers and subsequently to production, while farmers and olive oil mills around the world faced one of the most difficult harvests in recent memory.

In the annual survey of Oliveoiltimes.com, which was sent to 4,487 producers in 34 countries, the respondents gave the 2023 harvest a total rating of 51 out of 100, the lowest rating since 2018.

Farmers and olive mills were more disappointed with their performance, rating it just 46 out of 100, while they gave the lowest rating (72/100) for the quality of their production since the survey began.

The disappointment surrounding the yields underscored the widely covered decline in global olive oil production, which is expected to fall to 2.407 million tons in the 2023/24 crop year, the second consecutive decline and the lowest total since 2013/14.

Producers believe that stakeholders in the olive oil sector should focus on enforcing standards to reduce fraud, pressure governments for increased sectoral support, and embark on global marketing campaigns to promote olive oil consumption.