Greece’s economy is performing better than it did seven years ago, but a series of domestic and international risks could weigh on future growth, according to Ioannis Bratakos, president of the Athens Chamber of Commerce and Industry (ACCI).

Speaking at a briefing with journalists, Bratakos said economic indicators have improved, with positive growth rates, a stronger Athens Stock Exchange and higher overall economic values.

“The performance of the Greek economy today cannot be compared with where we were seven years ago,” he said.

At the same time, he said the country needs a comprehensive redesign of its production model in order to address emerging challenges. He identified geopolitical tensions, rising debt risks in Europe and the U.S., the economic impact of the climate crisis, and concerns over inflated valuations linked to artificial intelligence as key threats to economic stability. These factors, he said, underscore the need for coordinated planning to shield the economy from external shocks.

The commercial and industrial enterprises represented by the chamber account for about 50% of Greece’s gross domestic product.

Geopolitical Risks

Bratakos identified geopolitical developments as the most significant risk facing the Greek economy, pointing to the war in Ukraine and instability in the Middle East. He also referred to challenges involving neighboring Turkey, noting Greece’s geographic position in the region.

“These developments are worrying and threaten to slow investment,” he said.

Climate Costs

Climate-related damage poses another risk, Bratakos said. He cited flooding caused by Storm Daniel, which resulted in losses estimated at €4.5 billion.

He also referred to a study by the Foundation for Economic and Industrial Research (IOBE), which estimates the annual cost of the climate crisis to the Greek economy at €16 billion.

At lower growth rates, a loss of €4.5 billion relative to GDP would be difficult to absorb, he said.

Debt Pressures

While Greece’s public debt has been restructured and the debt-to-GDP ratio has declined, Bratakos said interest payments after 2032 could be difficult to service if growth averages around 2.1%.

He also warned that high debt levels in other economies could have broader repercussions, citing France, where public debt stands at about 120% of GDP, and the United States, where federal debt has reached $36 trillion.

A fiscal deterioration or global recession could affect Greece as well, he said.

AI Valuations

Bratakos included artificial intelligence (AI) among factors that could trigger global market disruptions, stressing that his concern relates to valuation levels rather than technological development.

He cited Tesla’s market capitalization, which rose to $1.7 trillion before declining to about $1 trillion, compared with a combined valuation of roughly $450 billion for other major global automakers.

“These are not real figures,” he said. “They are virtual values.”

He added that some financial institutions have warned that AI could become the next market bubble after the dot-com era.

Political Stability and Economic Policy

Bratakos said the accumulation of risks underscores the need for political stability in Greece, regardless of which government is in power. He also stressed that the country lacks a culture of cooperation.

The President of ACCI also emphasized the need for centrally designed and targeted policies to support a shift in the production model.

Business Debt and Financing

Outstanding obligations remain a burden for businesses, particularly smaller firms, Bratakos said. He argued that existing 24-installment repayment schemes do not adequately support debt servicing.

He proposed allowing businesses to settle obligations in 120 installments, adding that Greece’s fiscal surpluses could cover the cost. He said such arrangements could even be made permanent.

Access to Credit

Small businesses continue to face difficulties accessing bank financing, Bratakos said, noting that many are considered “unbankable” based on banking criteria.

To address this, the chamber is preparing a platform that would allow businesses to submit business and investment plans for evaluation. The chamber would issue a creditworthiness certificate that companies could use when applying for bank loans.

Energy Costs

High energy costs remain a challenge for Greek businesses and industry, Bratakos said. He called for state intervention to ease the burden and pointed to possible initiatives by Greece’s state-owned power utility (PPC).

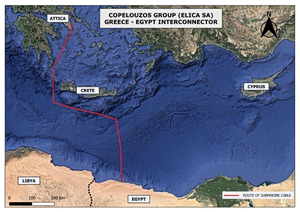

He also stressed the importance of advancing electricity interconnections, particularly cross-border projects, and highlighted the need to move forward with an electricity link between Greece and Egypt.