Greek shipping remains a leading force in the specific global sector, even in the face of pressure from new regulations, high investment requirements, and geopolitical turmoil, with the latest survey by Petrofin Research for 2024 showing a “year of restraint”, but also of strategic restructuring.

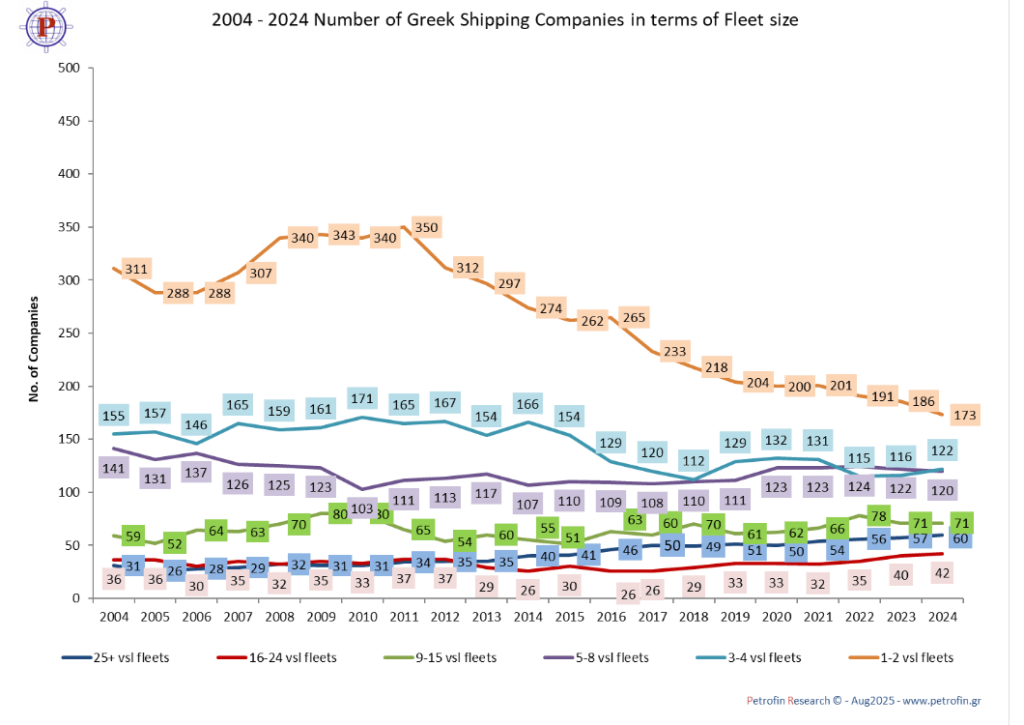

Specifically, the number of Greek-controlled shipping companies fell to 588 from 592 last year, according to the firm, confirming the trend towards consolidation in the sector. Smaller companies, mainly those with one or two vessels, are declining sharply (-24.9% in terms of DWT), as this size is considered unsustainable in the long term. In contrast, larger shipping companies with fleets of more than 25 vessels were up (+5.16%), and now account for almost 69% of the Greek-controlled fleet.

Large fleets dominate

For vessels with a transport capacity of more than 20,000 dwt, the “backbone” of Greek shipping continues to be dry bulk carriers, with 2,921 ships and an addition of 128 (+4% DWT) year-to-year. The tanker fleet increased by 24 vessels (+1% DWT) to 1,004. Containerships remained at 489, however, the top 10 Greek shipowners dramatically strengthened their presence in the sector (+63.5% in DWT).

Six vessels (+4.4% DWT) were added to the LNG carrier fleet, with the number of companies remaining unchanged and the total Greek-owned fleet increasing to 170 ships.

Clouds on the horizon

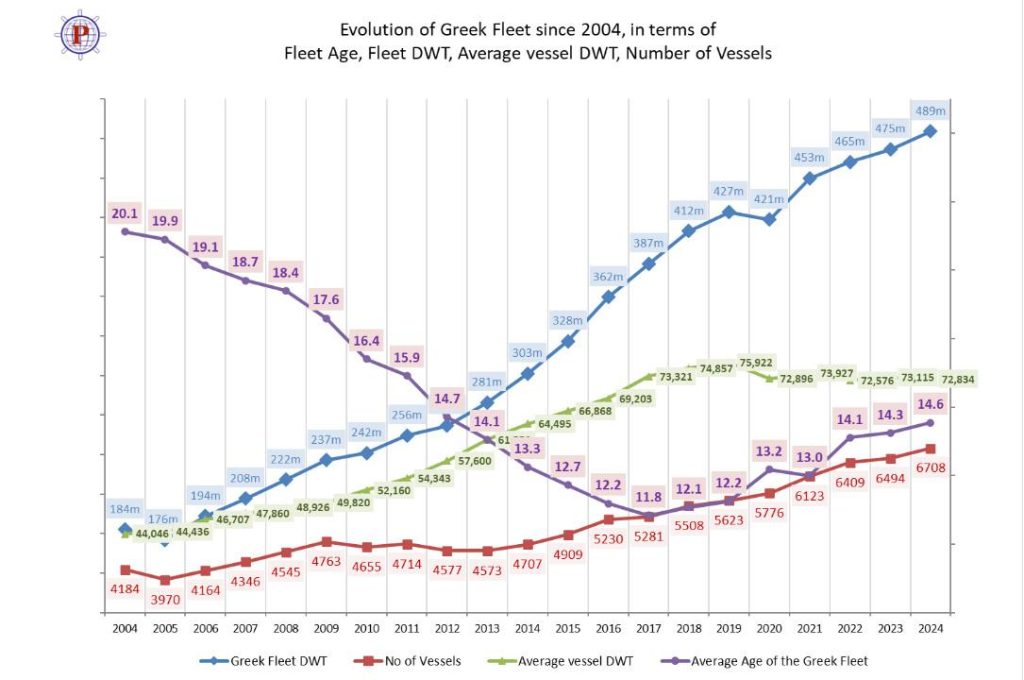

The average annual growth of the Greek fleet was limited to 4% in the period 2020-2024, compared to 7% in the previous decade, Petrofin Research notes. A similar trend is also observed globally. The slowdown is attributed to geopolitical tensions (Ukraine, the Middle East, trade “wars”), along with economic uncertainty (low growth, trade restrictions), stricter emissions regulations and uncertainty surrounding future fuels and high interest rates in the United States, which have restricted liquidity.

Despite these difficulties, Greece remains atop the top of the list for orders of “eco” ships, although only 3% of the order book concerns such “purely green” solutions. The majority of orders are conventional designs with scrubbers. Shipowners’ “strategic caution” in 2024 continues into 2025, with many adopting a wait-and-see attitude.

Pressure from the EU regarding emissions and a new US trade doctrine are apparently reshaping decisions on new orders.