Australia and Greece offer two very different stories in taxation. In Australia, tax reform is a continuous process of refinement, guided by evidence and economic modeling.

Successive governments, whether Labor or Liberal, have treated reform as a contest of ideas rather than political spin. Economists from Victoria University’s Centre of Policy Studies (Greek-Australian Jason Nassios and James Giesecke) show that inefficient taxes such as stamp duty[2] and insurance levies create large “excess burdens” on the economy, even at low rates. Their work strengthens the case for abolition, replacing them with broader, fairer bases such as income tax, payroll tax, or the GST[3]. Recent proposals suggest that replacing inefficient property and corporate taxes could raise real GDP by almost 6% and leave households around A$4,000 better off. The Australian way is to seek efficiency and equity simultaneously, ensuring households, business, and government share in the gains.

By contrast, Greece’s taxation has been largely ad hoc, politically opportunistic, and unstable. Each government re-writes rules for short-term gain, eroding trust and discouraging compliance.

Economic literacy among the electorate remains low, allowing clientelism to dominate. VAT illustrates this failure most starkly. Despite having one of Europe’s highest rates (24%), Greece loses up to a third of potential collections through evasion and weak enforcement. In January 2025, the European Commission issued formal warnings because Greece failed to transpose key VAT directives — one granting relief to small businesses, the other allowing reduced rates on essentials such as food and medicines. Months later, Greece still had not responded, risking referral to the European Court of Justice and fines.

We must note here that VAT in Australia (known as the Goods and Services Tax (GST)) is 10% on most goods, services and other items sold or consumed in Australia. Generally, basic foodstuffs are GST-free, while prepared meals, snacks, and beverages are taxable. The detailed VAT-free food list includes unprocessed or minimally processed foods such as fresh fruits and vegetables, meat, poultry, fish, eggs, and milk.

Production Possibilities Frontier

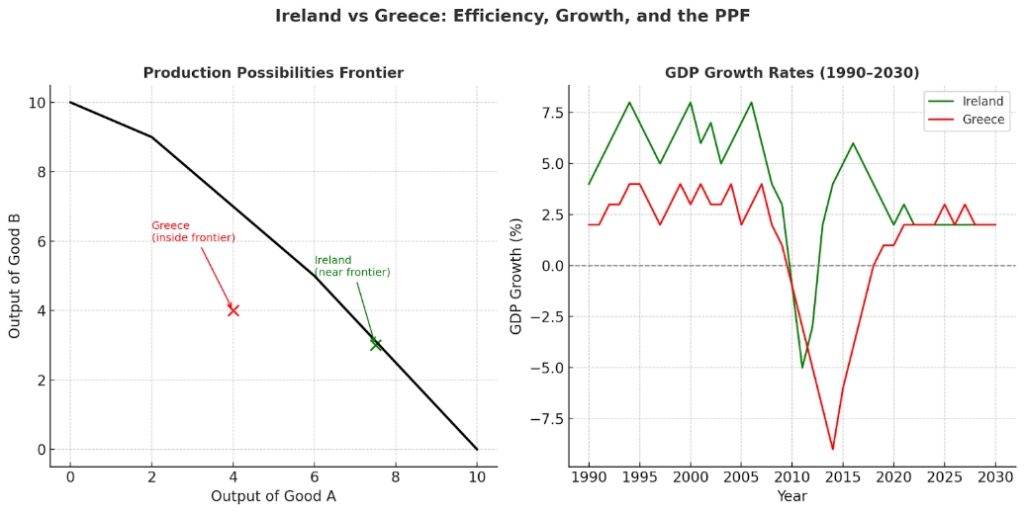

The consequences of tax inefficiency and policy instability become clearer when seen through the lens of the Production Possibilities Frontier (PPF). In comparative studies, Greece is shown to be operating inside its PPF, meaning it produces below its potential, given available resources and technology. Ireland, by contrast, is closer to its frontier — its economy consistently expands towards its potential output.

Figure 1: Comparative GDP Growth Rates, Greece and Ireland (2019–2024)

The figure highlights that while Ireland sustained strong growth rates, Greece remained trapped in a low-growth equilibrium, unable to convert reforms into productivity gains. Ireland, with barely half Greece’s population, already produces more than twice as much — a vivid demonstration of the cost of inefficiency and weak compliance. If Greece were to converge in efficiency and productivity to Ireland’s level, its potential GDP could be more than twice what it is today.

Thus, Greece’s tax inefficiency is more than an administrative failure; it is part of the reason why the economy remains stuck inside its PPF, leaving growth potential untapped.

VAT and European Commission Compliance

Greece’s VAT system demonstrates the practical cost of ad hoc policymaking. In January 2025, the European Commission issued letters of formal notice for Greece’s failure to transpose two directives:

- Directive (EU) 2020/285 – special VAT scheme for small enterprises, allowing exemptions or simplified rules.

- Directive (EU) 2022/542 – reduced or zero VAT rates on essential goods and 30% VAT reductions for specific regions.

As of mid-August 2025, Greece had not formally responded. Non-compliance risks referral to the European Court of Justice and fines, highlighting the economic and reputational costs of ignoring EU benchmarks.

Policy Success or Failure

Economic growth is the central criterion for policy evaluation, especially in countries like Greece facing complex geostrategic challenges.

Economic growth unfolds in two phases:

1.Easy Phase – rapid gains via reallocation of labor and capital.

2.Hard Phase – growth near the production frontier, requiring R&D and advanced capital.

Structural reforms that generate persistently high growth, prevent stagnation, and move the economy toward its production frontier are key. Tax reform is a primary instrument. Australia demonstrates continuous refinement that increases efficiency and potential output. Greece illustrates the opposite: politically driven tax decisions keep it inside its PPF and far from realizing potential.

Conclusion

The contrast is stark: Australia continuously updates its “software” of taxation to lift efficiency and equity, moving its economy closer to the production frontier. Greece, by contrast, clings to politically driven, unstable practices that leave it trapped well inside its frontier. Ireland, with barely half Greece’s population, already produces more than twice as much — a vivid demonstration of the cost of inefficiency and weak compliance.

Australia pays attention, reforms, and captures growth. Greece, by ignoring both European benchmarks and domestic inefficiencies, continues to pay the price: unrealized potential, stagnant growth, and a system that punishes work while enabling avoidance. The lesson is clear — structural reform, not political expediency, is the pathway to real economic progress.

References

Nassios, J., & Giesecke, J. (2025). Some taxes are inefficient at any level, even modest reforms will help. Centre of Policy Studies, Victoria University.

European Commission (2025). Directive (EU) 2020/285 and Directive (EU) 2022/542 transposition notices. European Parliament Documentation.

Australian National University Tax and Transfer Policy Institute (2025). Economic reform modelling reports.

Eurostat & ELSTAT (2025). Government Revenues and Tax Data.

Kehoe, J. (2025). The tax reform plan that leaves Australian households $4,000 better. Australian Financial Review.

[1] Former Professor of Economics, University of Victoria, Australia, steve.bakalis@gmail.com

[2] If you buy or acquire a property, you pay land transfer duty, commonly known as stamp duty.

[3] GST is the Goods and Services Tax which is the same as the VAT.