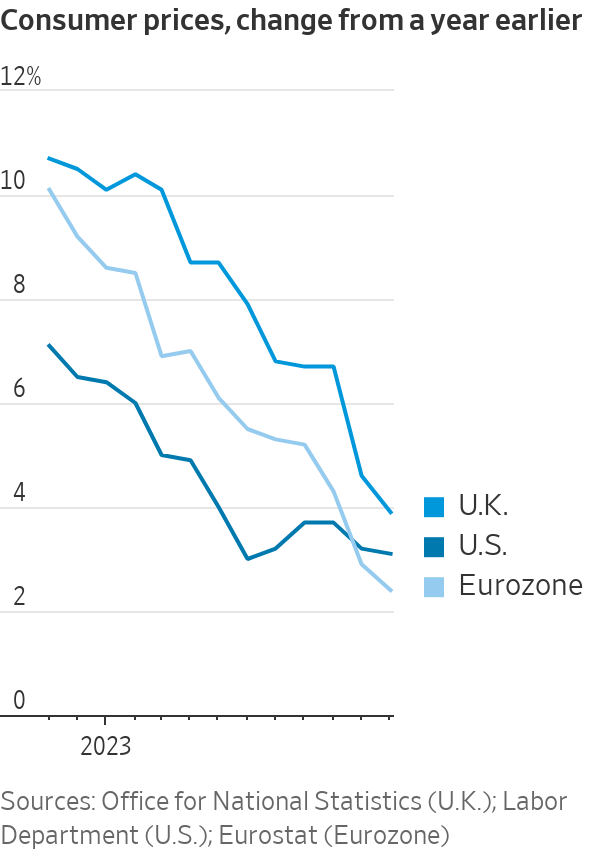

Call it a Christmas miracle: Inflation around the globe is slowing way faster than expected. If economists are right, that gift will keep on giving next year, bringing inflation back to normal levels for the first time in three years.

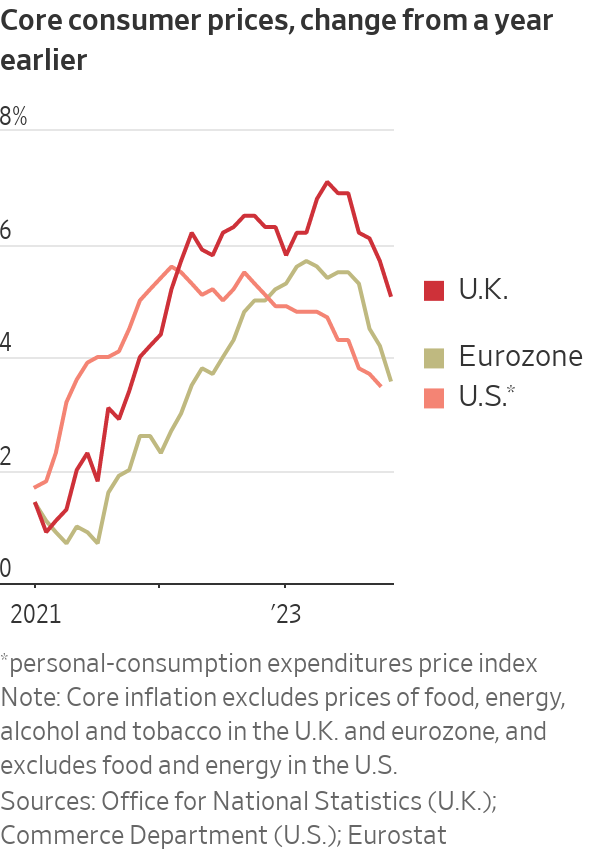

Goldman Sachs economists estimate that core inflation, which excludes food and energy, in the group of economies that experienced the post-Covid inflation surge—the U.S., Europe and several emerging markets—ran at a 2.2% annualized pace over the three months ended November.

By the end of 2024, average inflation among that group should be at or near the inflation targets of most major central banks, the analysts found.

Falling inflation should cushion economic growth in two ways: by bolstering household purchasing power and enabling central banks to cut interest rates.

Michael Saunders, senior adviser at Oxford Economics, expects inflation to reach 1.3% in the fourth quarter of next year in the euro area, and 2.7% in the U.K., while U.S. inflation will fall to 2.2% as measured by the Federal Reserve’s preferred personal-consumption-expenditures price index. That measure was 2.6% in November, the Commerce Department reported Friday. Excluding food and energy, it was 3.2%, and just 1.9% annualized over the last six months.

The Federal Reserve, European Central Bank and the Bank of England all target inflation of 2%.

The trans-Atlantic forces pushing inflation down

“The common factors pulling inflation down are food, energy, global goods prices and monetary policy,” said Saunders, a former member of the Bank of England’s Monetary Policy Committee. “But the differences, and why inflation will be quicker to return to target in the eurozone, is the U.S. and U.K. also have greater pressures from labor market tightness, which are fading only gradually.”

These improvements are the other side of the inflation waves that hit the global economy. First, in 2021, goods prices soared because of disrupted global production and shipping in addition to strong demand due to fiscal and monetary stimulus.

Russia’s invasion of Ukraine in 2022 then sent up commodity prices, causing inflation to hit multidecade peaks. Inflation in the eurozone, which suffered from a cutoff of Russian gas, peaked at 10.6% in October 2022.

Workforces were also stunted by Covid-related disruptions. So healthy demand for workers sent wage growth up sharply, feeding through to services inflation.

Housing costs have also fueled services inflation, with a lag. In the U.S., consumer prices rose 3.1% in November from a year earlier, but just 1.4% excluding shelter. The impact has been far smaller in Europe where owner-occupied housing is omitted from key inflation measures.

Unclogged supply chains drove down inflation toward the end of 2022 and throughout this year, and that will likely continue into next year. For instance, in the U.S., used car prices—a major initial driver of inflation—still have further to fall in early 2024 as the market gets back to normal, said Omair Sharif, founder of Inflation Insights.

Energy and commodity markets adjusted to the Ukraine disruption as well, helping bring down energy prices and stabilize food costs. These forces should continue to weigh on inflation in 2024, said Neil Dutta, head of economic research at Renaissance Macro Research. “Energy prices have come down and given the decline in diesel prices, we will probably see that bleed into food and grocery prices in the months ahead,” he said.

Labor markets in many major economies have begun rebalancing this year too, cooling wage growth, a key contributor to service costs. That should continue in 2024.

Again, the timing and impact will differ by country. “It’s arguably already happened in the U.S.,” said Peter Berezin, chief global strategist at BCA Research, adding that wage pressures have abated due largely to an influx of workers into the labor force.

Tight labor markets may slow progress

Progress will likely be slower in the U.K., where unusually high disability rates due to wait lists for care have reduced labor supply, said Simon MacAdam, senior global economist at Capital Economics. While inflows of immigrants are at a record, their skills often don’t match vacancies, he said.

Calming inflation, along with slowing or stagnating growth across major economies, sets the stage for rate cuts next year.

The Fed earlier this month signaled it would cut interest rates. “The economy is doing reasonably well. Financial conditions have eased. Earnings have improved,” Dutta said. In that situation, the Fed is more likely to deliver three to four quarter-point rate cuts rather than the six the market expects, he said. “But it should feel pretty good—it should feel like a soft landing.”

That prospect has already sent bond prices up and yields down, lowering borrowing costs for U.S. companies and home buyers. European borrowers may have longer to wait; they are more dependent on banks than capital markets, and bank loan rates are closely linked to central bank interest rate targets, said MacAdam. Bank loan rates won’t fall significantly until the second half of the year in the eurozone, and possibly even later in Britain because of stickier inflation, he said.

With inflation crumbling around the globe, Bank of America strategists project 152 global central bank rate cuts next year, the most since 2009, they said.

Douglas Porter, chief economist at BMO Capital Markets Economics, expects most major economies to grow more slowly in 2024 than in 2023, but rate cuts, cooling energy and food prices, and normalized supply chains will stave off a globalrecession.

Write to Gwynn Guilford at gwynn.guilford@wsj.com