The U.S. Securities and Exchange Commission voted Wednesday to allow mainstream investors to buy and sell bitcoin as easily as stocks and mutual funds, a decision hailed by the industry as a game changer.

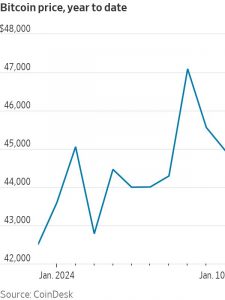

The SEC decision clears the way for the first U.S. exchange-traded funds that hold bitcoin to be sold to the public. Expectations of U.S. regulatory approval for such funds drove the price of bitcoin to the highest level in about two years. The digital currency traded just below $46,000 late Wednesday, up from $17,000 in January 2023.

Until now, everyday investors who wanted to buy and sell digital currencies have had to either trade on crypto exchanges and incur hefty transaction fees or purchase products that track bitcoin in less direct ways. At least half a dozen bitcoin-futures ETFs are already on the market. Those funds use futures contracts to provide exposure to bitcoin price moves, though they have been criticized for often straying from bitcoin’s price.

All 11 applications filed by asset managers including BlackRock, Fidelity Investments, ARK Investment Management, Invesco, WisdomTree, Bitwise Asset Management, Valkyrie and Grayscale Investments have been greenlighted to list. The new funds, known as spot-bitcoin ETFs because they buy and sell the digital currency itself, are expected to begin trading on Thursday.

“Today is a monumental day in the history of digital assets,” Samir Kerbage, chief investment officer at bitcoin ETF issuer Hashdex, said in a statement.

Crypto assets were mixed after the SEC’s decision. Ether, the second largest digital currency rose nearly 10%. Coinbase Global, the largest publicly traded crypto exchange whose stock price tends to move in tandem with bitcoin, fell 1.4% in after-hours trading. Coinbase is listed as the custodian on eight of the 11 spot-bitcoin ETF applications.

The SEC previously rejected applications for so-called spot bitcoin ETFs on the grounds that the underlying market is vulnerable to fraud and market manipulation. SEC Chair Gary Gensler has said more regulation and investor protection is needed before a swath of investors get access to the crypto market.

Gensler acknowledged the latest ETF applications were similar to ones the SEC had denied in the past. But he said a court ruling last year in favor of crypto asset manager Grayscale had compelled the change.

“Based on these circumstances and those discussed more fully in the approval order, I feel the most sustainable path forward is to approve the listing and trading of these spot bitcoin ETP shares,” he said.

He added the SEC “did not approve or endorse bitcoin.”

“Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto,” Gensler said.

The argument that the bitcoin market is rife with fraud and easily manipulated got a boost Tuesday when the SEC’s official X account was hacked.

The SEC order Wednesday noted that all the exchanges seeking to list bitcoin ETFs had a surveillance-sharing agreement with the Chicago Mercantile Exchange, where bitcoin futures are listed. That agreement “can be reasonably expected to assist in surveilling for fraudulent and manipulative acts and practices,” the order said. It cited the high correlation between bitcoin-futures prices and the price of bitcoin itself.

Two of the SEC’s five commissioners, Democrats Caroline Crenshaw and Jaime Lizarraga, voted against the decision. Crenshaw called the move “unsound and ahistorical,” saying it puts the agency “on a wayward path that could further sacrifice investor protection.”

The SEC’s two Republican commissioners, Hester Peirce and Mark Uyeda, joined Gensler in voting to approve the ETFs.

“Today marks the end of an unnecessary but consequential saga,” Peirce said. She said the SEC’s previous rejections used perplexing logic and drove individual investors to less-efficient ways of gaining exposure to bitcoin.

The approval order, posted on the SEC’s website Wednesday, detailed how the agency has reversed its thinking about the risk of market manipulation in bitcoin in response to the August court decision.

After losing the Grayscale lawsuit, the SEC said, it studied the correlation between the spot-bitcoin market and the CME bitcoin futures market. Grayscale had claimed that the two markets were closely correlated, and the judges sided with the crypto asset manager in their decision. The SEC said after the new analysis, it is able to conclude that fraud or manipulation that impacts prices in spot-bitcoin markets would likely similarly affect CME bitcoin futures prices.

The unauthorized X post Tuesday claimed that the agency had approved these funds. Bitcoin initially jumped and then reversed its gains when the agency later posted that its account was compromised. The SEC said Wednesday that the agency’s Office of the Inspector General and the Federal Bureau of Investigations are now probing the incident.

Gensler has previously taken to X to say that investments in crypto assets can be “exceptionally risky and are often volatile.” Several crypto firms have filed for bankruptcy, and fraudsters continue to exploit the rising popularity of crypto assets to lure individual investors into scams, he had said.

Despite such risks, many mainstream investors have flocked to crypto assets in recent years, sending prices soaring during the pandemic. In 2022, though, the collapse of several high-profile crypto exchanges caused prices to crash, wiping out $2 trillion in cryptocurrency value. The sector’s implosion culminated with the failure of FTX, the exchange ran by now-convicted crypto entrepreneur Sam Bankman-Fried.

The likelihood of a spot bitcoin ETF being sold to the public appeared low until BlackRock, the world’s largest money manager with a near-perfect record of ETF approvals, threw its hat into the ring in June 2023.

The new bitcoin funds are expected to face intense competition in a crowded market. Some asset managers have chosen to compete on cost, while others have begun a marketing push. Fees for some of the funds will range from as low as zero in the first six months to as high as 1.5% of assets.

The fund approvals could potentially pave the way for some financial advisers to recommend that clients allocate funds to bitcoin. It is far easier for an adviser to recommend an ETF than bitcoin itself, which could require clearing a number of regulatory hurdles.

Bitcoin skeptics said the approval of spot-bitcoin ETFs could set a dangerous precedent for other crypto-asset ETFs to come to market in the future and make it more difficult for the SEC to protect investors. Several asset managers, including BlackRock, ARK, VanEck and Grayscale, have filed applications to launch the first ETFs that track the second-largest cryptocurrency, ether. The SEC faces a final deadline this May to approve or reject some of those funds.

“This is going to open the floodgates for every type of crypto token and scam you can think of that’s going to be trying to get SEC approval.” said Dennis Kelleher, president of Better Markets, a group that advocates for tighter financial regulations.

PubKey, a bitcoin-themed bar in New York, posted a photo on X saying that it would be having an ETF party. “There’s always room in the rocket,” the bar wrote. Hashdex, one of the bitcoin ETF issuers, was poised to hold an event at PubKey on Wednesday evening.

—Alexander Osipovich and Dave Michaels contributed to this article.

Write to Vicky Ge Huang at vicky.huang@wsj.com and Paul Kiernan at paul.kiernan@wsj.com