The revival of the so-called “3+1 Alliance”—bringing together Greece, Cyprus, Israel and the United States—has triggered renewed international attention over who will shape the future of energy in the Eastern Mediterranean, one of today’s most geopolitically sensitive regions.

The alliance was reactivated in Athens on 6 November, on the sidelines of the Power & Energy Transition Conference (P-TEC), nearly six years after it first emerged. Energy ministers from the three regional states agreed to give fresh substance to the partnership, with a clear objective: diversifying energy supply routes, reducing dependency risks, and strengthening Western involvement in the region’s gas reserves and infrastructure.

At the same time, Washington’s renewed interest—combined with the growing role of US energy companies in offshore gas fields, LNG transport, and the ambitious IMEC corridor (India–Middle East–Europe)—is opening the door to new investment and geopolitical alignments.

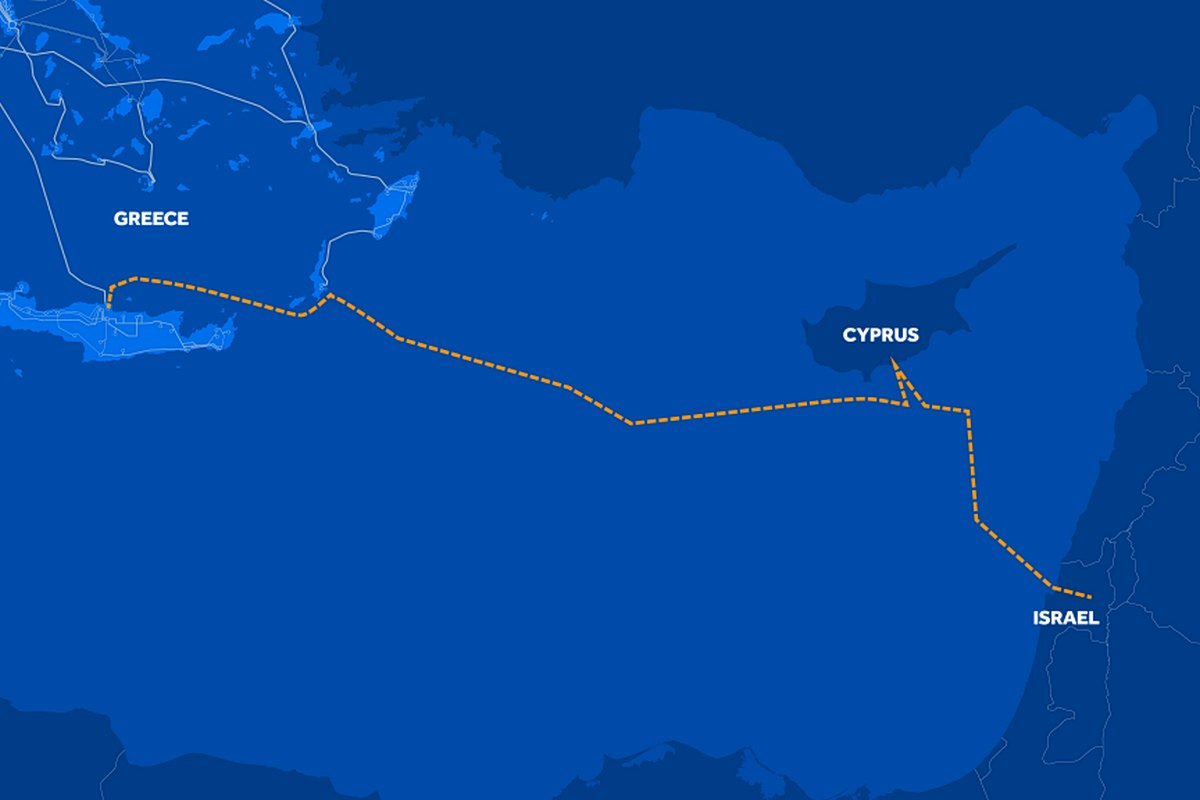

The Greece–Cyprus–Israel power link (GSI)

According to diplomatic sources, the trilateral summit in Jerusalem on 22 December, bringing together Greek Prime Minister Kyriakos Mitsotakis, Cypriot President Nikos Christodoulides and Israeli Prime Minister Benjamin Netanyahu, is expected to focus heavily on political backing for flagship projects under the 3+1 framework.

Chief among them is the long-discussed Great Sea Interconnector (GSI)—the electricity link connecting Greece, Cyprus and Israel. The Cypriot parliament recently approved funding for its share of the project, while Brussels continues to classify it as a project of strategic importance within the EU’s “Grids Package”.

Greece is pushing to restart construction, while talks are under way regarding the participation of international investment funds. Israel has repeatedly voiced strong support for the GSI, seeing it as a key tool for energy diversification and security, reducing its reliance on natural gas for electricity generation.

The possible involvement of US capital is expected to bring Washington more actively into the picture, particularly in terms of geopolitical guarantees for the project’s security.

The interconnector will span 1,208 kilometres of subsea and onshore cables, including 898 kilometres between Crete and Cyprus. It will have a capacity of 1,000 MW, operate at 500 kV, and reach seabed depths of up to 3,000 metres. The estimated cost stands at €1.9 billion.

EastMed: from mega-pipeline to modular strategy

When the 3+1 Alliance was first launched in 2019, one of its cornerstone ambitions was the EastMed gas pipeline, a 1,900-kilometre project designed to transport gas from Israel’s Leviathan field and Cyprus’s Aphrodite field to Greece and onward to Europe.

That plan was effectively shelved in 2022, after the United States deemed it economically unviable. Originally designed in 2013 by a consortium led by Edison and Greece’s DEPA, the project may have been abandoned in its original form—but not in spirit.

A “new EastMed” is now taking shape: a network of smaller interconnecting pipelines, combined with LNG terminals across the Eastern Mediterranean. Once again, the US factor is central in shaping this evolving energy map.

This reimagined EastMed concept is also expected to feature prominently on the agenda of the Jerusalem summit.

Israel–Egypt gas axis gains momentum

In recent months, Israel and Egypt have reached agreements to channel gas from the Leviathan field to Egypt. The role of Chevron, which operates Leviathan, is pivotal. The US energy giant is developing new infrastructure to transport gas from the field to production platforms, while also expanding the capacity of the existing Israel–Egypt pipeline.

Similarly, Energean, through its Israeli subsidiary, has signed an agreement to export 1 billion cubic metres of gas annually via the Nitzana pipeline, currently under construction.

Energean’s deal to supply Cyprus

Energean is also moving ahead with exports of Israeli gas to Cyprus. The company has signed a preliminary agreement with Cyfield Group for a new 200-kilometre subsea pipeline linking the Energean Power FPSO—which produces gas from the Karish and Karish North fields—to Cyfield’s power generation facilities in Mari, near Larnaca.

A Letter of Intent has already been signed for the annual supply of 0.3 billion cubic metres of gas.

Cyprus gas bound for Egypt—and Europe

Cyprus itself has secured agreements with Egypt to export gas from the Aphrodite and Cronos fields to the LNG terminals at Idku and Damietta. Aphrodite is operated by Chevron, Shell and NewMed, while Cronos is controlled by Eni and TotalEnergies.

In practical terms, gas from Israel and Cyprus will flow to Egypt, where it will be liquefied and shipped onward to Europe as LNG.

Greece as Europe’s energy gateway

At the centre of this evolving energy architecture stands Greece, positioning itself as a key energy hub for Europe. Through the Revithoussa LNG terminal and the Alexandroupolis FSRU, natural gas will be channelled toward Eastern European markets.

Following recent agreements announced during P-TEC, US LNG cargoes will also reach Europe via Greek infrastructure—cementing Greece’s strategic role in the continent’s post-crisis energy security.

In the high-stakes energy game of the Eastern Mediterranean, the revived 3+1 Alliance is no longer a diplomatic concept—it is rapidly becoming a decisive force shaping the region’s future.