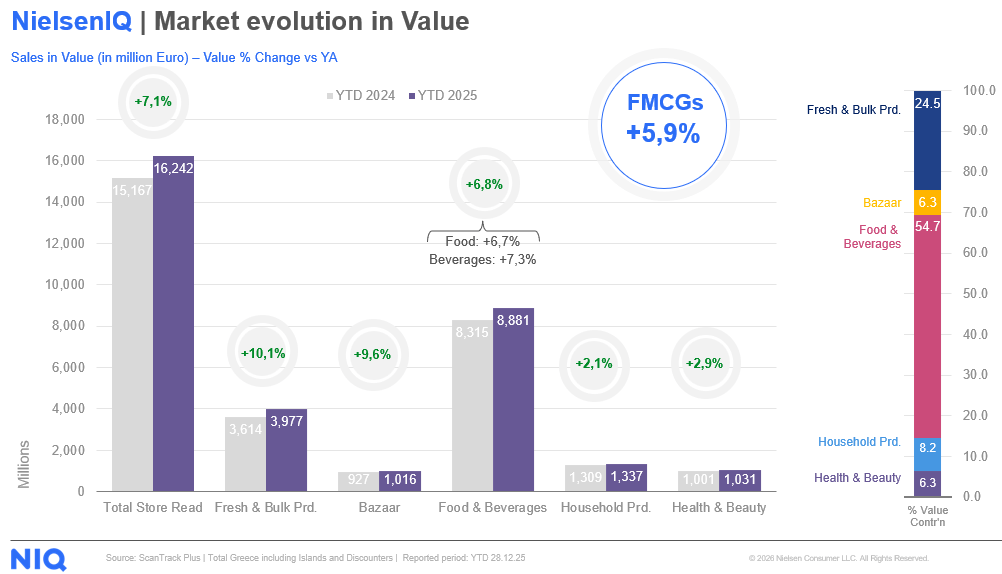

Greece’s supermarket sector experienced a notable 7.1% increase in sales in 2025, according to the latest NielsenIQ data. The total turnover of organized food retail reached €16.2 billion, driven primarily by rising consumer demand.

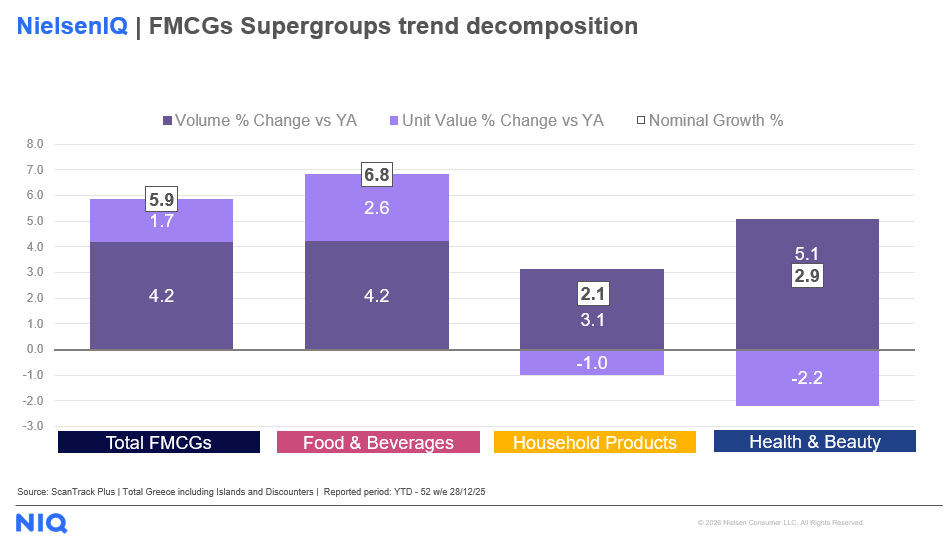

Fresh and bulk items—including meat, fish, fruits, and vegetables—recorded the highest growth, up 10.1%, followed closely by non-food items like clothing, toys, and electronics, which rose 9.6%. Fast-moving consumer goods (FMCGs) accounted for 75% of overall sales and increased by 5.9%, reflecting strong demand rather than price hikes, as the average basket price grew only 1.7%.

Other product categories showing significant growth included snacking (+10.9%), dairy (+9.5%), pet care products (+8.7%), and non-alcoholic beverages such as coffee and cocoa (+8.0%). Meanwhile, household care and personal hygiene products saw continued price declines.

All store formats benefited, with hypermarkets up 8.8%, mid-sized supermarkets (+8.9%), and small convenience stores (+9.0%). This trend reflects both chain network restructuring and a shift toward neighborhood “convenience” stores. Conversely, traditional retail channels like kiosks and small shops fell by 2.8%.

Regionally, the Ionian and Aegean Islands (+10.0%) and Crete (+9.6%) led growth, while Athens, which accounts for 41% of total consumption, saw more moderate gains at +5.9%. Analysts attribute much of the growth in tourist-heavy areas to strong visitor demand and trends in home meal preparation, highlighting the ongoing impact of tourism and lifestyle shifts on Greece’s retail food market.