tovima.com - Breaking News, Analysis and Opinion from To Vima’s International Edition

Latest News

-

Epstein Scandal Sends Shockwaves Through the British Establishment

-

Govt Eyes 2 Temporary Migrant Detention Camps on Crete

-

Digital Work Card System Rolled Out by End of 2026

-

Greek PM Reiterates Athens’ Standing Positions Ahead of Erdogan Meeting

-

What Does It Mean to Constitutionalise AI?

-

AI Traffic Cameras Document Thousands of Violations in Athens

-

Riviera Tower Reaches 40th Floor; 10 Remaining (Vid)

-

Yemen: A Country with 2 Souls and a Civil War Without End

-

How to Start Building Wealth in 2026

-

Trump: America, India Reach Trade Deal; Lower Tariffs Immediately

-

The Revenge of Paper

-

Major GHB Bust in Central Athens

-

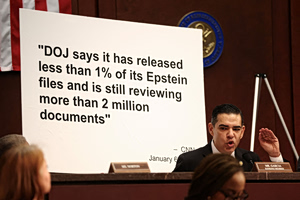

Epstein Files Release Exposes Names of at Least 43 Victims, WSJ Review Finds

-

Tyler, the Creator Eyes a Film Collaboration with Yorgos Lanthimos

-

Melania Documentary Premieres in Athens

-

Eurostat: 19% in Greece Couldn’t Heat Homes in 2024

-

Video Shows Moments Before Victim Was Abducted

-

Latest Batch of Epstein Files Show Greece-Related Exchanges During Bailout Era

-

efood Delivery Drivers Announce 24-Hour Strike

-

Trump Threatens Lawsuit Over Trevor Noah’s Grammys Joke

-

Europe’s $955B Recovery Fund Faces Delays in Boosting Economy

-

Turks Travel to Alexandroupoli for Affordable Grocery Shopping

-

Capital Clean Energy Carriers: Driving developments in LNG transportation worldwide

-

Crete Fisherman Dies in Atlantic Storm at Age 33

-

Two Minors Attack 16-Year-Old in Crete, Parents Also Arrested