tovima.com - Breaking News, Analysis and Opinion from To Vima’s International Edition

Latest News

-

Athens in Top Five Preferred Destinations in 2025

-

Flu Surge in Greece Sends Children to Hospitals

-

UPD – Chios Coast Guard Fire on Human Traffickers, Fatalities Reported (video)

-

Greek Households Struggle to Make Ends Meet, Report Says

-

National Bank Survey Shows Greek SMEs Resilient Despite Tariffs

-

Greek Women’s Water Pole Team Loses in Euro 2026 Semi-Final

-

Yogurt for Dinner: Light Bite or Weight-Loss Myth?

-

These People Went From Hoarders to Extreme Minimalists. Here’s How.

-

Greece May Be Next to Ban Social Media Use for Minors

-

US Shoots Down Iranian Drone Near Aircraft Carrier

-

Fake ELTA Delivery Texts Target Greek Consumers

-

Greece Urges EU, U.S. Action on Vertical Gas Corridor

-

Hundreds of Swiss Bank Accounts With Suspected Nazi Links Found by Investigators

-

Greek National Arrested for Alleged Sabotage of German Warships

-

DESFA LNG Slot Auction Sees Near-Full Booking

-

Son of Norway’s Crown Princess Held in Custody as Rape Trial Begins

-

The Board of Peace, the United Nations, and Europe in a Fragmented World

-

Power, Fashion and Rivalry in ‘The Devil Wears Prada 2’

-

Kalamata Mural of Maria Callas Named World’s Best Street Artwork of 2025

-

OPEKEPE Parliamentary Inquiry Wrapping Up Amid Tensions

-

Athens 2nd Olive Oil Forum: Science, Taste, and Strategy

-

EU Endorses Prinos CO₂ Storage Project as Key Climate Infrastructure

-

Greek Government Launches National Diploma Reform Talks

-

TO VIMA Exclusive Interview with Carla Sands, Former US Ambassador to Denmark

-

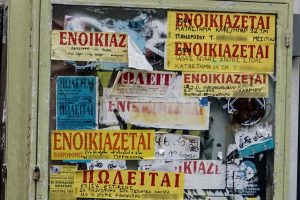

Greek Property Draws Turkish Investors Seeking Inflation Haven