A report by mononews reveals the “vague and general,” as it describes, response of the European Commission to a question from a Lithuanian MEP regarding whether ships owned by the Alafouzos family transported Russian oil despite sanctions. According to the report, the Commission avoided giving clear answers and refers the responsibility for enforcing the measures to the member states, leaving key questions unanswered.

Although the European Commission’s position, published on Nov. 18, 2025, does not directly answer the specific allegations raised by the MEP but makes general references to the sanctions framework, this can be interpreted as the Commission investigating the matter in depth and possibly reserving the right to respond to the allegations in the near future once more evidence is gathered.

Sources noted that the Commission is still investigating the matter, on the occasion of the Lithuanian MEP’s tabled question.

To date, the Commission’s reply has not announced new names of companies or EU individuals who would face separate sanctions. Instead, it focuses on the broader framework of measures already in place, extended to limit the operation and economic role of the shadow fleet, the report adds:

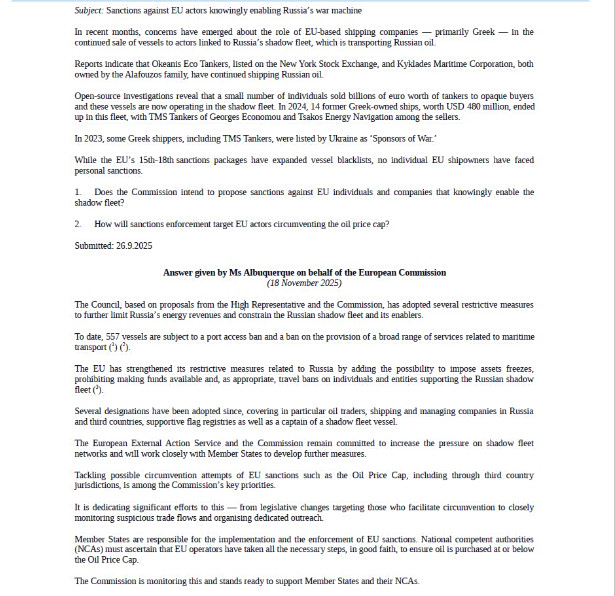

It is recalled that on September 26, 2025, a written question (E-003761/2025) was submitted to the European Parliament by Lithuanian MEP Petras Auštrevičius, member of the Renew Europe political group, concerning the transport of Russian oil in circumvention of EU sanctions via the so-called shadow fleet.

The question asked the European Commission to clarify whether it intends to consider imposing sanctions on European entities that, according to journalistic and other reports, may facilitate such transports. Mentioned among these are the shipping companies Okeanis Eco Tankers and Kyklades Maritime, owned by the Alafouzos family.

Commission: Nat’l competent authorities must ensure that EU entities have taken all necessary measures in good faith to ensure that oil is purchased at or below the price cap

“The Council, based on proposals from the High Representative and the Commission, has adopted various restrictive measures aimed at further limiting Russia’s revenue from energy and restricting the Russian shadow fleet and those who support it. To date, 557 vessels are subject to port entry bans and prohibitions on a wide range of shipping-related services.

The European Union has also reinforced the sanctions measures applied to Russia by adding the ability to freeze assets, restrict the availability of funds, and, in certain cases, impose travel bans on individuals and entities supporting the Russian shadow fleet. Since then, many listings have been adopted, covering mainly oil trading companies, shipping and management firms in Russia and third countries, supportive registries, as well as a captain of a shadow fleet vessel.

The EU External Action Service and the Commission are committed to increasing pressure on shadow fleet networks and will cooperate closely with member states to develop further measures. Addressing potential attempts to circumvent EU sanctions, such as violations of the oil price cap, including by third-country jurisdictions, is a central priority for the Commission.

The Commission dedicates significant efforts to this, from legislative changes targeting facilitators of circumvention, to intensive monitoring of suspicious trade flows, and the organization of awareness and cooperation actions. Member states are responsible for implementing and enforcing EU sanctions. National competent authorities must ensure that EU entities have taken all necessary measures in good faith to ensure that oil is purchased at or below the price cap. The Commission monitors this process and is ready to support member states and competent national authorities where needed.”

The Question (E-003761/2025)

This is an official written question to the European Commission, submitted by MEP Petras Auštrevičius (Renew) on September 26, 2025. It asks the Commission to clarify its position and the measures in place regarding the issue.

Specifically, whether the Commission intends to propose sanctions against European entities (natural or legal persons) who knowingly facilitate shadow fleet operations, and how sanctions would be applied to potential violators circumventing the EU oil price cap and other sanctions. The question names Okeanis Eco Tankers and Kyklades Maritime, associated with the Alafouzos family, noting that “according to reports, they continue to transport Russian oil” and highlighting that, despite actions against the shadow fleet, no personal sanctions have yet been imposed on European shipowners.

Involvement of Okeanis Eco Tankers and Kyklades Maritime

Since the outbreak of the Russia-Ukraine conflict and subsequent sanctions, international media reports have referenced activities of the publicly listed Okeanis Eco Tankers and the family-owned Kyklades Maritime, owned by Giannis Alafouzos and his son Aristidis Alafouzos. A related question was submitted to the European Commission by MEP Petras Auštrevičius (Question for written answer E-003761/2025).

According to reports from April 2025, Alafouzos family vessels allegedly transported cargoes from Russian ports after the Russian invasion of Ukraine, raising questions about full compliance with Western sanctions on Russian energy.

In October 2025, the MEP officially requested that the European Commission examine the possibility of sanctions against Okeanis Eco Tankers and Kyklades Maritime due to links with the “shadow fleet,” transporting Russian oil.

According to reporting by the Wall Street Journal and Greek media, ships controlled by the Alafouzos family have visited Russian ports dozens of times since the start of the war, sometimes transporting Russian crude or cargoes originating from Russian ports.

The company has stated that Okeanis Eco Tankers stopped transporting Russian oil in 2023 following investor requests, but the family continued to transport Russian oil with private vessels.

Okeanis CEO Aristidis Alafouzos has publicly stated that the company does not rely on shipments “subject to sanctions” and that Black Sea cargoes were mainly from the CPC terminal, which contains significant Kazakh crude not under sanctions.

However, shipping data analysis shows Russian crude transfers occurred even when Urals crude—used as a benchmark for Russian oil—traded above the price cap, raising questions of potential sanctions circumvention.

Ship Visits

According to Vortexa data, Alafouzos family vessels have made approximately 140 visits to Russian ports since the start of the war in Ukraine.

Several of these involved the transport of Kazakh crude via Russian ports. In 2025 alone, there were nine shipments of Russian crude.

Statements by Giannis Alafouzos

In mid-August 2022, Giannis Alafouzos addressed criticism regarding Russian oil transport:

During a conference call on Okeanis Eco Tankers’ H1 2022 results, which were positive, he stated that all major Western oil companies buy and transport Russian oil.

“I do not understand all this hypocrisy about not going to Russia, when the whole world needs and transports Russian oil,” G. Alafouzos stated.

In a message to TradeWinds, he added: “The global energy balance is very tight, and Europe could not disengage from Russian crude and its products, as shown by the recent relaxation of EU sanctions. According to Bloomberg (‘A Storm Brews in Heating Oil’ by Javier Blas), Russian exports to Europe were at pre-war levels in June and July.”

He also noted that “Europe currently buys diesel from non-EU countries at high prices, mainly from India, originating from discounted Russian crude, worsening the European energy crisis and competitiveness.”

Alafouzos explained that “at the war’s start, the company decided not to transport Russian oil, but later observed that even oil giants were buying Russian crude, and the EU itself facilitated insurance for these shipments.”

TradeWinds reported on May 17, 2024, that Aristidis Alafouzos highlighted that Okeanis’ agreed VLCC charter rates were $75,900/day for 82% of the days (April–June) and Suezmax rates $60,800/day for 57% of capacity, 50% and 48% higher than competitors, raising questions from investors about operational efficiency.

The Shadow Fleet

The EU sanctions packages have identified the so-called shadow fleet, a large network of aging tankers with opaque ownership and inadequate insurance, used to circumvent sanctions and the Russian oil price cap. Measures include blacklisting vessels from EU ports and services.

The European Parliament has called for stricter monitoring and sanctions against tankers exporting Russian oil circumventing sanctions, including owners and operators. Enhanced inspections and enforcement are required.

According to TankerTrackers.com, the shadow fleet comprises 1,480 active vessels, categorized by flag, size, and age.

Top flags by number of vessels:

- Panama: 186

- Russia: 184

- Cameroon: 103

- Iran: 98

- Sierra Leone: 95

- Comoros: 68

- Gambia: 64

- Guinea: 51

- Curaçao: 50

- Guyana: 50

- Palau: 48

- Oman: 37

- Barbados: 35

- Hong Kong: 33

- Aruba: 27

- Benin: 27

- Liberia: 27

- Marshall Islands: 27

- Cook Islands: 20

- North Korea: 18

Top crude flows (barrels/day):

- Iran → China: 1,675,340

- Russia → India: 992,930

- Russia → China: 895,898

- Venezuela → China: 638,054

- Russia → Unknown: 260,035

- Iran → UAE: 120,041

- Russia → Turkey: 114,775

- Saudi Arabia → China: 74,647

- Russia → Syria: 64,347

- Kazakhstan → India: 52,788

By vessel size:

- Handysize/Handymax: 633

- Aframax: 366

- VLCC/ULCC: 233

- Suezmax: 151

- Panamax: 97

By year built:

- 2003: 151

- 2004: 143

- 2005: 143

- 2006: 118

- 2002: 99

- 2007: 89

- 2008: 84

- 2000: 81

- 2009: 69

- 2001: 65