Greece’s Independent Power Transmission Operator, known as ADMIE, is approaching a critical moment that could shape the country’s energy future for decades as it seeks funding for large-scale electricity transmission projects that are essential to the country’s energy security and regional role.

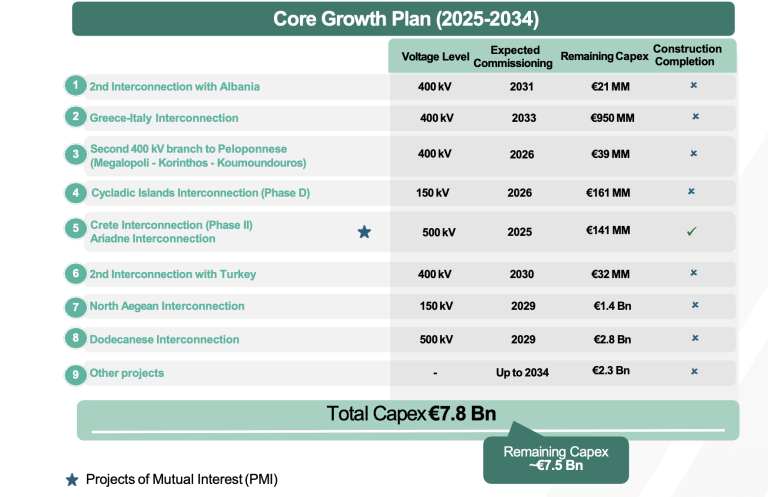

According to ADMIE’s latest presentation during the announcement of its nine-month financial results, the operator has lined up projects worth €7.5 billion covering the period from 2025 to 2034. These include both domestic and international electricity interconnections and supporting infrastructure.

Urgent need for capital

Market sources say ADMIE needs an immediate capital injection to complete existing projects and move forward smoothly with its ambitious investment program. Greek banks have estimated that fresh funding of about €1.1 billion will be required.

ADMIE’s main development projects (2025–2034), with capital expenditure totaling €7.5 billion

This capital boost, combined with a weighted average cost of capital (WACC) of 7.45%, which is higher than current borrowing costs, would allow ADMIE to unlock additional bank financing. Such funding could further expand its regulated asset base and support attractive regulated returns in the years ahead.

ADMIE’s regulated asset base is already approaching €3 billion and stands at €2.846 billion in 2025.

Global funds show interest

According to information cited by market sources, several major international investment funds have expressed interest in participating in ADMIE. These include BlackRock, Meridiam, Fortress, Fidelity, KKR and TAQA, among others.

Their participation would require a share capital increase, a move that market observers believe could successfully raise the targeted €1.1 billion. The entry of a top-tier global fund would signal strong backing for ADMIE’s infrastructure plans and, according to financial circles, could mark another significant turning point for the Greek economy.

Strategic projects with regional impact

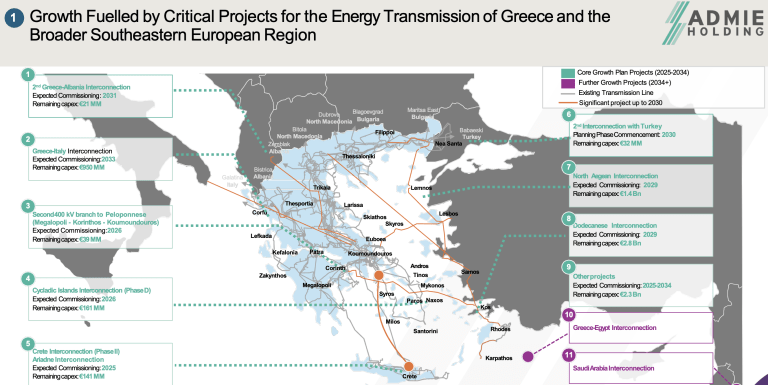

ADMIE’s development program for 2025–2034 goes beyond securing Greece’s energy needs. Key domestic projects include the €2.8 billion electricity interconnection of the Dodecanese islands and a €1.4 billion project linking islands in the North Aegean, both aimed at strengthening supply reliability and reducing dependence on local generation.

Also under consideration are a series of large-scale international electricity interconnections shaped by shifting geopolitical dynamics in the Eastern Mediterranean and the wider Eurasian region. At this stage though, most of these projects remain at the level of feasibility studies and strategic planning

ADMIE’s major electricity interconnection and infrastructure projects

ADMIE is aspiring to become a leading player in linking Europe with Saudi Arabia through the proposed SaudiGreek Interconnection, connecting Greece with Egypt via the GREGY project, and enhancing transmission links with the Western Balkans and Central Europe under the proposed Green Aegean Interconnector.

The most transformative project is widely seen as the long-discussed Great Sea Interconnector (GSI), which would link Greece, Cyprus and Israel through a subsea electricity cable.

In addition ADMIE along with Terna, Italy’s national grid operator, have already signed a Memorandum of Understanding regarding the second electricity interconnection between Greece and Italy, which is aimed for completion in 2033 with a budget of €950 million. Further strategic projects include second interconnections with Albania and Turkey.

Government decisions loom

Any share capital increase at ADMIE requires a decision by the Greek government. Such a move would reshape the operator’s shareholder structure, introducing a strategic investor while allowing the Greek state to retain a statutory blocking minority of 34%. At present, the state directly and indirectly controls 51% of ADMIE, while China’s State Grid holds a 24% stake.

Diplomatic and energy sector sources note that U.S. backing for Greece’s energy role in the Southeastern Mediterranean, expressed after November’s P-TEC’s conference, has effectively encouraged Athens to approve investments in companies and infrastructure deemed vital to the country’s geopolitical security.

“Time is running out,” diplomatic sources and energy analysts warn, adding that key decisions must be taken no later than the second half of January.