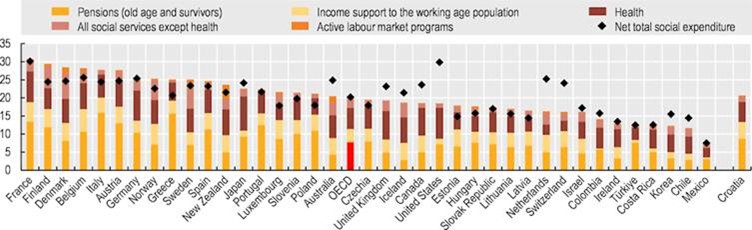

From Russia, to South Korea, to Germany, and dozens of others, the coming global demographic crisis plagues the minds of governments, academics, and voters alike. This is no wonder, as pension spending has already reached an average of 7% of GDP in the OECD, and the calamitous dependency ratio between working and non-working age populations teeters on the edge of economic inviability for many. At the center of the crisis, among others, stands the well-known fiscal trap holding most, but especially European, governments hostage.

The dilemma famously goes as such: facing a reduction in tax revenue due to fewer producers, and a simultaneous increase in spending commitments due to the increase of pensioners, governments must either tax their already overburdened worker populations, or drastically reduce spending on welfare, with both moves, as protests in several countries have already proven, rightfully being politically unpalatable and politically untenable to the point of career suicide for many politicians.

Society at a Glance 2024: OECD Social Indicators

The point of this article however, is not to rehash what is already common knowledge for those even passively following the issue, but rather to propose a possible solution to the aforementioned fiscal trap. Naturally, this article focuses specifically on Southern Europe and the west, but its proposals are still applicable to non-western countries with an asymmetry of wealth and a demographic crisis.

Reduced to its core, the demographic crisis presents governments with an impossible balancing act. By increasing spending in the way of welfare while at the same time decreasing income in the way of tax revenues, policymakers are strong-armed into either economically and politically painful spending cuts or economically and politically painful tax hikes. Extrapolating from this, if governments were to either reduce spending, or increase tax revenues, the bulk of their demographic adjacent budgetary woes would be offset, or even undone. With this in mind this article seeks to propose a voluntary, yet restrictive, multilateral, and highly coordinated program that would do just that, by encouraging (though not forcing) the wealthy middle and upper middle class retirees of the west to settle in the comparatively poorer, depopulated, and tax starved Southern Europe, allowing their home governments to reduce state pension allowances for participants without jeopardising their standard of living.

While odd sounding at first, with one’s immediate reaction being a mix of negativity and comparison to the golden visa/citizenship programs popular across the south of the continent, the more one explores this uncomfortable idea, the more they understand the rationale behind it.

The tax on the consumption and pension incomes of foreign retirees would reinvigorate the economies and narrow fiscal spaces endemic to the south of Europe, offsetting its demographic related budgetary headspin by increasing tax revenue without burdening the working age population. It would also mean a reversal of the depopulation driving the death of its rural and deindustrialised communities. The rest of the wealthy west on the other hand, would be equally relieved of its weighty fiscal burden, as the seniors taking up this program would see their pensions reduced to a level where in combination with their own private pension programs, savings, and earnings from home sales, they could live a more than comfortable life in the comparatively low cost of living countries in the south of Europe.

Of course, such a program would face many legal, political, and economic challenges. Barring the legality of such a scheme on the national level of other countries, a significant issue would be that of the ability of EU/Schengen pensioners to move and live wherever on the continent freely, negating their need for any multilateral arrangement for them to be allowed to live in Southern Europe. Their lack of participation however, could be offset by the millions of Canadian, British, Australian, Japanese, and especially American pensioners, who have already proven to be open to moving to the Mediterranean’s quieter and more beautiful shores, as evidenced by the British retirees numbering in the hundreds of thousands in Spain and Portugal alone.

No, the real problems facing this program would be concerns over increased cost of living, xenophobia, and increased infrastructure spending, leading us to the differentiating factor between this scheme and golden visas: the heavy and necessary state interventionism and guiding hand on the part of Southern European nations.

First, rather than allowing settlements to freely coalesce around already overburdened cities and tourist hotspots, endangering a harmful increase in the cost of living for locals and the creation of a two speed economy, settlement must be targeted to smaller, dying, rural, and deindustrialised communities most in need of funds and life, and capped as a percentage of the local population as to prevent the previously mentioned economic drawbacks, as well as xenophobic backlash from the (predominantly more conservative) local population.

Second, such a program would also see increased short term costs for southern countries, as connectivity and healthcare infrastructure would certainly need to be upgraded in order to keep up with both the uptick in population as well as the higher standards of retirees hailing from more developed economies. The final and most crucial hurdle, would be that of xenophobic backlash, one cannot ignore, the reality is that immigration is now a very hot button issue in Europe as of late, but western retirees may indeed be less likely to trigger political backlash, as they are predominantly non-competitive in the job market, and culturally aligned with host populations.

Ultimately, due to the controversial nature of its subject, such a program would have to navigate and overcome a multifaceted, diverse, and dangerous field of opposition. Other issues to consider would be those of countries encouraging their retirees to move abroad. Resistance to cutting pensions, concerns over losing domestic consumption, and the complexity of cross-border healthcare provision are all legitimate concerns that warrant their own article, but in the face of all negativity one thing must be made absolutely clear, and that is the reality that whatever opposition there may be, it is sure to be nowhere near the level a government would face should they cut life saving benefits, or stonewall development for the already economically ailing millennial and Gen-z generations. Finally, whether the political and economic calculus supports this idea’s feasibility or not may be up for debate, but what isn’t is the reality that only innovative, sometimes uncomfortable, and non-traditional solutions stand a real chance of addressing the seemingly insurmountable odds the world’s economies are facing, and not basic 20th century fiscal tweaks.

This op-ed is part of To BHMA International Edition’s NextGen Corner, a platform for fresh voices on the defining issues of our time.

*Orpheas Afridi is a member of ELIAMEP’s EU Youth Hub, and is a British-Greek university student passionate about European, African, and global affairs in an unstable world.