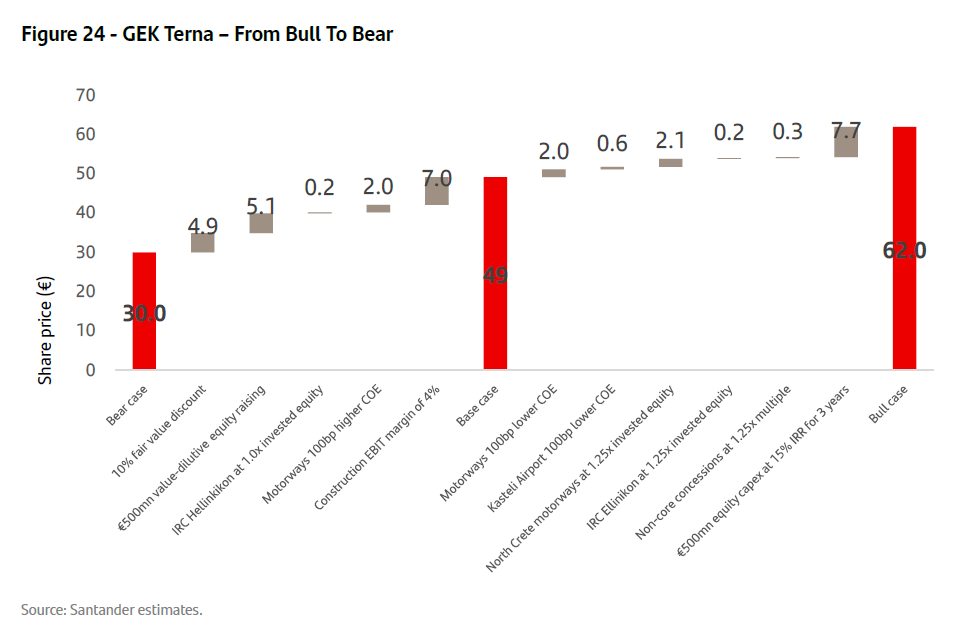

With an “outperform” recommendation and a target price of 49 euros per share for 2026, implying an upside potential of more than 90%, Santander on Wednesday initiated coverage of GEK TERNA, while stressing that current share prices do not reflect the company’s true value.

The Spanish banking group said GEK TERNA is currently the largest Greek transport infrastructure development and concession group, and is undergoing a phase of profound corporate restructuring. This transformation began with the sale of TERNA ENERGY in the fourth quarter of 2024 and continues with the rapid addition and development of new transport infrastructure in the period 2026–2030.

Although the GEK TERNA stock has performed strongly over the past five years, Santander assessed that the market is far from ascribing the true value prospects of the group’s infrastructure portfolio.

Motorways: The group’s ‘value locomotive’

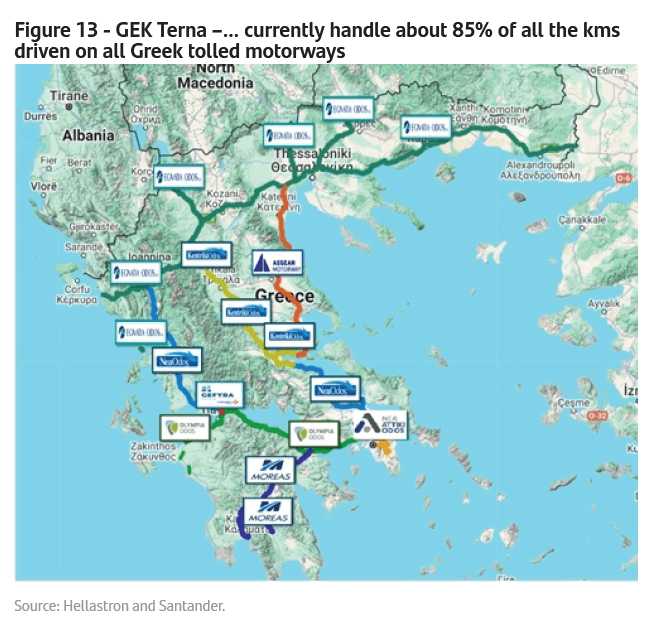

GEK TERNA’s motorway concession portfolio is the central axis of its investment potential. Taking advantage of the third wave of privatizations in Greece, GEK TERNA has built up a particularly strong portfolio in just a few years, one that manages approximately 85% of traffic on toll motorways in Greece and represents approximately 75% of the group’s fair value.

The portfolio has a weighted average duration of more than 27 years and includes four mature concessions with proven traffic (Attiki Odos, Nea Odos, Kentriki Odos, Olympia Odos), Egnatia Odos, and two motorways in northern Crete that are under construction.

Santander’s analysis shows that these assets could lead to a near doubling of EBITDA by 2030 and dividends by 2031, creating a steep upward equity value curve through 2032.

Kastelli Airport

In addition to motorways, Santander also attaches particular value to other concessions, notably the new Kastelli Airport on the large island of Crete, in which GEK TERNA holds a 32.46% stake.

When the facility opens in 2027–2028, the airport will be able to handle around 17 million passengers a year, almost double the capacity of the existing Nikos Kazantzakis Airport. Santander points out that the project is characterized by negligible future capital requirements, a long concession period until 2055, and low leverage, as it had a net cash position of 160 million euros at the end of 2024.

Based on the data, Kastelli is estimated to be able to support high dividends, initially around 70 million euros per year, which could reach up to 180 million euros towards the end of the concession, with the peak value occurring in 2036.

Towards a rapid deleveraging

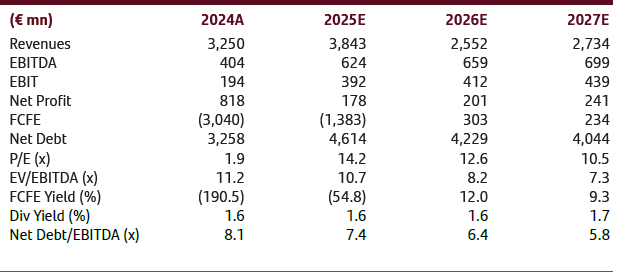

Although at a consolidated level the net debt to EBITDA ratio appears high (above 7x at the end of 2025), Santander emphasized that approximately 98% of the debt is linked to the concessions themselves. Corporate net debt is limited, and it is estimated that, without new major concessions or a change in dividend policy, GEK TERNA will be in a near-net cash position by 2030, reaching net cash of approximately 1.2 billion euros by 2035.

A key factor is the expected increase in dividends from the infrastructure portfolio, from 33 million euros in 2024 to almost 150 million euros in 2030 and more than 300 million euros by 2035.

Share undervaluation and attractive risk/return

Santander concludes that the market values GEK TERNA in a way that implies negative value for the motorway portfolio, which it considers unjustified.

Based on its calculations, the fair value of these assets is close to €2.5 billion, which is roughly the current market value of the entire group, which suggests a significant undervaluation of the other activities, such as Kasteli airport and the highly profitable construction sector.

Overall, Santander believes that GEK TERNA offers a particularly attractive risk-return profile, with long concession durations, strong cash flow visibility, and significant upside potential for the stock.