Greece and the United States are stepping up efforts to activate the Vertical Corridor gas route, coupling diplomatic pressure on Brussels with a first commercial shipment of U.S. liquefied natural gas (LNG) to Ukraine — a signal of determination from both governments despite European hesitation and market skepticism.

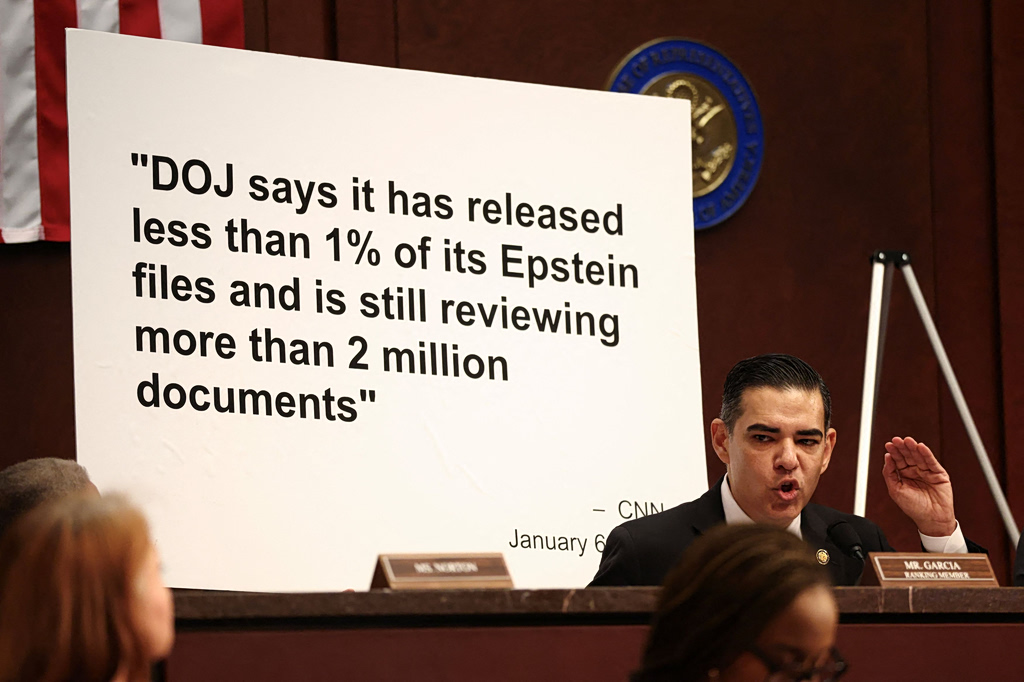

Two developments mark the latest escalation. First came the U.S.-led announcement that energy ministers from the five countries participating in the Vertical Corridor will meet Feb. 24 at the White House to address regulatory and commercial bottlenecks. Days later, on Friday, Jan. 30, Atlantic SEE LNG Trade signed its first sale agreement for U.S. LNG to Ukraine’s state energy company, Naftogaz, with delivery scheduled for March 2026.

Taken together, the diplomatic initiative and the commercial agreement reflect a coordinated attempt by Athens and Washington to move the corridor from blueprint to functioning supply route.

The White House meeting comes at a delicate moment for the project. A recent capacity auction for the Vertical Corridor produced no meaningful uptake, underscoring the gap between strategic rhetoric and market appetite. The corridor, which relies on interconnected gas networks linking Greece to Ukraine, has struggled to attract traders under its current commercial and regulatory framework.

Energy Minister Stavros Papastavrou, who will represent Greece at the Washington talks, said earlier on Monday in an interview with Greece’s public broadcaster that “the success of the Vertical Corridor changes the balance of power. It creates alternative routes for Europe, upgrades Greece’s role as a reliable energy hub in the region, and limits Turkey’s energy leverage. It is a matter of national interest and strategic choice. It is much more than a natural gas corridor. It is a corridor of trade, transport and connectivity.”

He reiterated that the project is “a complex undertaking without precedent. It is neither simple nor temporary, but strategic.”

Papastavrou also linked Greek and U.S. determination to the European Union’s decision to ban all Russian gas imports by 2027, arguing that the EU “cannot on the one hand support Ukraine, which is facing an illegal invasion, and on the other hand continue financing Russia.”

Similar arguments have been echoed in recent weeks by U.S. officials, who have repeatedly emphasized that the European Union pledged to purchase up to $750 billion worth of American energy products over the next three years and to phase out Russian gas imports by 2027. Ensuring that the Vertical Corridor becomes operational is viewed as part of delivering on that commitment. As Politico notes, the U.S. already supplies more than a quarter of the EU’s gas — up from just 5% five years ago — with dependence expected to rise further once a full Russian gas ban takes effect.

Joshua Volz, the U.S. Special Envoy for Global Energy Integration, recently said the corridor is currently operating “in drops” and must move toward sustained “flows,” emphasizing both strong political backing and the need for commercial realism. He stated explicitly that “this is not a charity project. It requires commercial realism to succeed.”

In remarks to the Greek newspaper Parapolitika, Volz acknowledged that alternative northern routes exist through Lithuania and Croatia. However, he argued that Greece has significant underutilized capacity and can channel large volumes more quickly than would be possible if other routes had to be expanded to serve Central and Eastern Europe.

U.S. Ambassador to Greece Kimberly Guilfoyle also highlighted Greece’s potential role as an energy hub for Eastern Europe and called for EU regulatory clarity to ensure that American LNG can reach consumers at competitive prices.

According to sources familiar with ongoing discussions, several adjustments are being examined, including the potential development of additional floating storage and regasification units (FSRUs) in Greece and a shift from monthly to quarterly capacity auctions to provide greater commercial predictability. Officials are also working to finalize the terms governing the three corridor products — Route 1, Route 2 and Route 3 — so they fully comply with EU competition rules, a key condition for restoring market confidence.

Meanwhile, the Atlantic SEE LNG Trade agreement offers an early test of commercial viability. The joint venture — in which AKTOR Group holds 60% and DEPA Commercial 40% — signed the deal on Jan. 30 for LNG supplied by BP. The cargo is expected to arrive at the Revithoussa terminal near Athens before being transported north via Route 1 through Bulgaria, Romania and Moldova to Ukraine in March 2026.

Konstantinos Xifaras, chairman of the joint venture and CEO of DEPA Commercial, described the agreement as a move “from planning to implementation.” Alexandros Exarchou, chairman and CEO of AKTOR Group, said the deal demonstrates that the corridor can deliver tangible results and urged the EU to align regulatory action with its stated objective of banning Russian gas imports.

Yet the broader European picture remains complex. Russian gas still accounts for roughly 13% percent of EU imports in 2025, worth more than €15 billion annually. Countries such as Hungary and Slovakia have been among the most resistant to the phase-out and have vowed to challenge the REPowerEU regulation before the European Court of Justice.

At the same time, EU officials have warned against replacing one dependency with another. Energy chief Ditte Juul Jørgensen has said, according to Politico, that American LNG remains essential in the short term but stressed the need to diversify supply further, with Brussels exploring deeper ties with Canada, Qatar and Algeria. Those sensitivities have intensified amid geopolitical turbulence and renewed strains in transatlantic relations — including tensions over Greenland — complicating what is otherwise framed as a strategic energy partnership.

For Greece, the Vertical Corridor represents an opportunity to position the country as a gateway for alternative energy flows into Southeastern and Central Europe. For the United States, it is both a strategic lever and a major commercial opportunity.

Whether diplomatic resolve and initial LNG transactions can overcome regulatory hesitation and limited trader interest remains the central question. The corridor has gained political momentum but its long-term viability will depend on whether those early signals translate into sustained, competitive flows.

Sources: ot.gr, politico.eu, energypress.gr