The message could hardly have been more dramatic. In a full-page appeal published in the German newspaper Welt, a letter addressed an unlikely addressee—competitiveness itself.

“Dear Competitiveness,” it began. “For so long we were a dream team. You were my driving force, my pride, my promise for tomorrow. Together we developed innovations, secured jobs, prosperity. But now? More and more obstacles stand between us: bureaucracy, costs, uncertainty. They take the air we breathe, darken our plans for the future. I want you back!”

This public cry of desperation came from the VCI, Germany’s Chemical Industry Association—the largest network of chemical and pharmaceutical companies in Europe, representing some 2,300 German firms. When a sector of this size takes out an emotional ad begging the country to save its competitiveness, the alarm bells are unmistakable.

“The Knockout Is Approaching”

With a €240 billion turnover in 2024 and more than 560,000 employees in Germany, the chemical industry has long been one of the central engines of the nation’s innovation and prosperity—not just domestically, but globally.

Or rather, it was.

Today, the sector is in crisis. The latest quarterly results are bleak: production has fallen below profitability thresholds, while prices and sales have once again declined. Expectations for exports—a cornerstone of Germany’s economic identity—not only failed to materialize but worsened. Sales outside Europe dropped sharply, and there is no sign of improvement on the horizon.

“The government knows how serious the situation is,” says Wolfgang Große Entrup, CEO of VCI. “But despite the special €500 billion fund created to restart the economy, there is no recovery in sight. If nothing changes, Germany will continue destroying itself… the knockout is approaching.”

Entrup’s warning is far from isolated. A storm is gathering across multiple sectors—none more symbolic than Germany’s automotive industry.

The Auto Industry Under Strain

Germany’s automotive sector, long the country’s flagship export machine and a global synonym for engineering excellence, is facing its own reckoning.

According to Handelsblatt, German carmakers posted €17.8 billion in earnings before interest and taxes this year—almost half of last year’s figure. Companies have been cutting jobs one after another, a trend expected to continue into next year. The industry is gasping for breath, squeezed by relentless competition from China and aggravated by newly imposed U.S. tariffs.

And, insiders warn, German policymakers still seem unable to grasp the core issue: the future of the automotive industry lies squarely in electromobility, where China has already emerged as a dominant global force.

“I have never experienced anything like the current situation,” says Michael Waasner, managing director of a family-owned company with 380 employees. “The auto industry is under pressure—partly because of internal combustion engines,” he adds pointedly.

This is where the political problem crystallizes. The German government insists that the EU’s decision to ban internal combustion engines from 2035 is a mistake—and is pushing to overturn it. In the eyes of many in the industry, this resistance is steering the sector straight onto the rocks.

“These Are Not Investments”

And the chancellor?

He had promised “prosperity by summer,” mocked Social Democrat Olaf Scholz as a “plumber of power,” and dismissed Green politician Robert Habeck as a “children’s book author.” He raised expectations for innovation, pledged an autumn of structural reforms, accelerated competitiveness, more jobs, reduced bureaucracy, and digitalization.

But autumn is ending, Germany’s growth rate is close to zero for the third consecutive year, and the outlook remains grim.

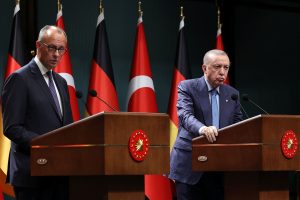

Over the last twelve months, 160,000 jobs have been lost. Bureaucracy remains a heavy drag. Business leaders welcomed the decision by Friedrich Merz to create Germany’s first Ministry of Digital Policy. The new minister, Carsten Wulffberger—formerly CEO of Ceconomy, the parent company of electronics chains Saturn and MediaMarkt—has taken initial steps, but significant progress will take time.

As for near-term recovery?

Germany’s so-called Five Wise Men, the country’s official Council of Economic Experts, forecast growth of around 0.9% in 2026. But, as economic analyst Jens Bastian tells To Vima, “It is a forecast and must be treated with caution. Next year brings political uncertainty due to elections in several federal states. And we have no way of knowing how the war in Ukraine will evolve.”

Subsidies Disguised as Investments

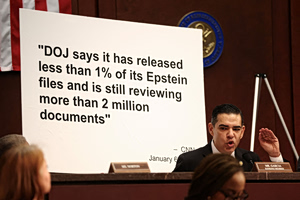

In the 2026 federal budget, borrowing from special funds for defense and infrastructure investments will exceed €180 billion—an astronomical figure whose effectiveness is increasingly questioned.

“Many of the expenditures described as investments are not actually investments in productive sectors,” argues Emily Heslanger, researcher at Munich’s respected Ifo Institute. “They are disguised subsidies.”

She points to measures such as reduced taxes for the gastronomy sector: “Does that really bring growth?”

Monika Schnitzer, professor of Comparative Economics at the University of Munich and head of the Five Wise Men, echoes the criticism. “Or does the discount on airline tickets foster growth? We need to ask why we are not directing money toward measures that accelerate development.”

According to both experts, these questions should have been addressed long ago.

Uncomfortable Truths

Much of this reckoning should, in fact, have begun under Angela Merkel. But during years of economic abundance, instead of investing in innovation, infrastructure, competitiveness, and mobility, the former chancellor chose to stand firmly behind Finance Minister Wolfgang Schäuble’s doctrine of balanced budgets—effectively putting the country on autopilot.

Overestimated abroad, Merkel failed to read the geopolitical signals coming even then from Russia, and fell short of domestic expectations.

As economic analyst Jens Bastian—now living in Greece and working with the Hellenic Foundation for European and Foreign Policy (ELIAMEP)—notes, “People, even in Germany, struggle to accept uncomfortable truths.”

“Germany tried to lecture Greece with its finger raised,” he reminds us, speaking during a seminar at the German Institute for International and Security Affairs in Berlin. “But if we look at Greece today—its economic growth, its fiscal situation, digitalization, pensions—there are significant improvements. Politically controversial, painful to implement, but real.”

Germany, he argues, could learn from what Greece has achieved over the past 15 years—progress that, despite hardships, has left the country in a better position than it was a decade ago.